Turbo of the week: Around 80% possible by the end of the year

Countries like Germany, Great Britain, and Poland are investing billions in their defense—in new systems, modern jets, and powerful engines. At the same time, civil aviation is booming with the comeback of long-haul flights. And the energy transition also requires cutting-edge technology—from low-emission engines to mini-nuclear power plants. A British technology group has positioned itself at a premium in all three areas.

Whether it's fighter jets, wide-body aircraft, submarines, or small modular reactors, the UK-based company is one of the silent winners of the current transformation – both on the stock exchange and in the markets.

The British industrial heavyweight is strategically well positioned and boasts high margins, growing cash flows, and ambitious targets through the end of the decade. Particularly exciting: New programs, including the multi-billion dollar AUKUS project and Europe's future fighter jet, could provide the next growth spurt. Despite international trade barriers, the company remains robust – and technologically one step ahead.

You can find out which revolutionary technologies in aviation and energy are now giving the British high-tech group a boost – and how investors can achieve returns of up to 80% with the right turbo note – in the current issue of DER AKTIONÄR starting on page 62.

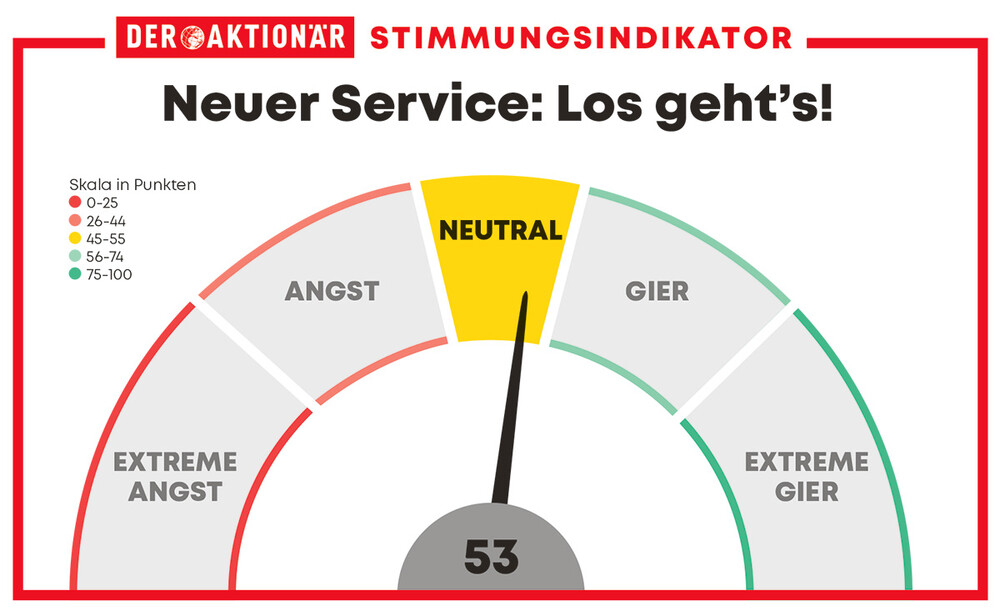

New service in the magazine : DER AKTIONÄR will now publish a weekly market barometer measuring sentiment on the German stock market – from "extreme fear" to "extreme greed." The value (0 to 100 points) is derived from eight factors, including volatility, the put-call ratio, and momentum. The barometer currently stands at 53, indicating a neutral sentiment.

DER AKTIONÄR sentiment indicator – now in every magazine issue, in this one on page 9.

DER AKTIONÄR sentiment indicator – now in every magazine issue, in this one on page 9.Rely on valuable long-term information for your investments with a trial subscription to DER AKTIONÄR. This subscription allows you to read four digital magazine issues for €19.90 and also gives you access to exclusive online articles at deraktionaer.de/plus.

To the AKTIONÄR trial subscription