Colombia pays the sixth highest interest rate on debt in the world and its fiscal situation is "unsustainable," a report reveals.

One of the country's main economic concerns in recent months has been the high cost of public debt. According to the 2025 Medium-Term Fiscal Framework, Colombia will have to allocate approximately 86 trillion pesos to interest payments, equivalent to 4.7 percent of gross domestic product (GDP), one of the highest levels in history.

This significant payment is largely due to the continued rise in the cost of public debt. For example, the 10-year government bond (TES) rate has increased 240 basis points in the last year, rising from 10.3 percent in June 2024 to 12.7 percent in June 2025.

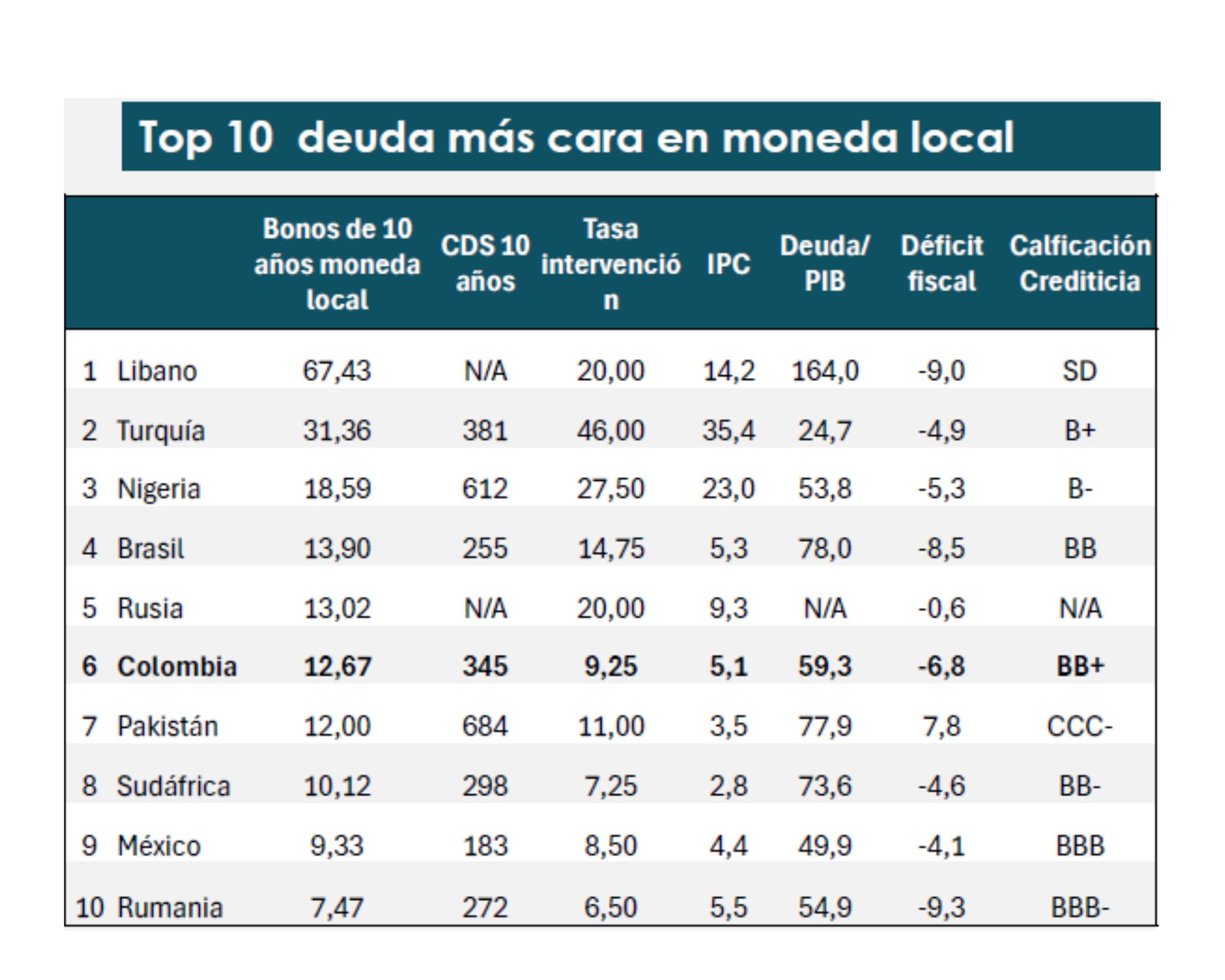

Most worrying is that Colombia ranks sixth in the world with the most expensive debt, when measured by the 10-year sovereign bond rate in local currency, according to a report by Banco Popular's Economic Research team.

With a rate of 12.67 percent, it is surpassed only by Lebanon, Turkey, Nigeria, Brazil, and Russia. This figure is even higher than that of countries like Pakistan (12.0 percent) and South Africa (10.1 percent).

"The High Cost of Debt" report by Banco Popular's Economic Research team. Photo: Banco Popular's Economic Research team

This high level reflects the high risk premium the market perceives for Colombia, especially when compared to the macroeconomic fundamentals of the countries in this group.

Despite the fact that the Central Bank's benchmark interest rate is lower than Pakistan's, Colombia still pays higher interest rates. In fact, countries with more expensive debt than Colombia have considerably higher benchmark rates and inflation rates.

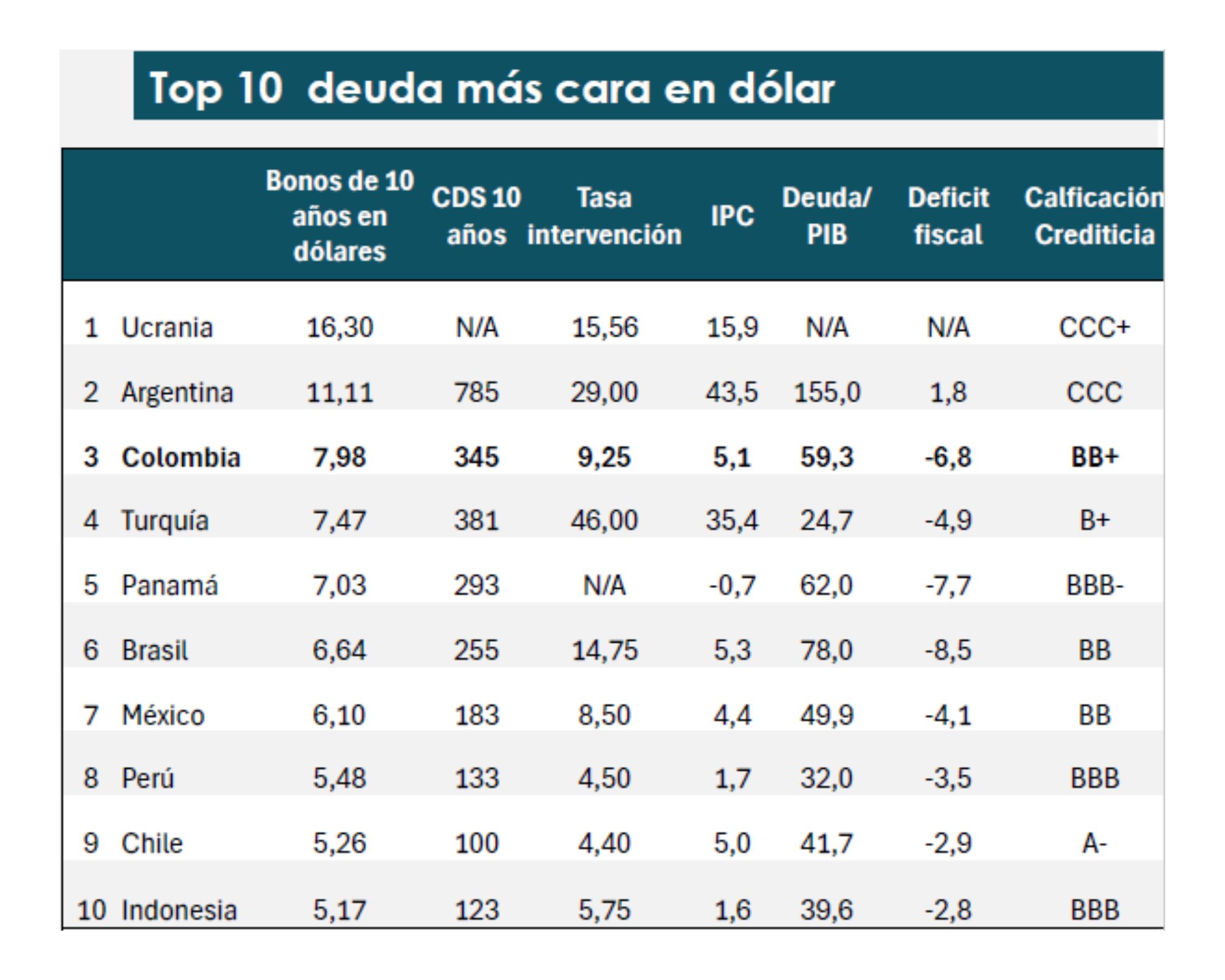

For Banco Popular's Economic Research team, the situation is even more delicate when analyzing the debt rate on 10-year dollar-denominated bonds: Colombia is among the three countries with the highest cost, behind only Ukraine and Argentina.

This pattern is also observed when comparing the 10-year Credit Default Swap (CDS), where the Colombian indicator reaches 345 points, surpassed only by Argentina (785) and Turkey (381).

Taken together, these indicators highlight the complex outlook facing Colombian public debt in international markets. The accumulated fiscal deterioration of recent years, coupled with uncertainty about the country's economic future, has significantly increased the risk premium.

"The High Cost of Debt" report by Banco Popular's Economic Research team. Photo: Banco Popular's Economic Research team

Although the market anticipates a possible credit rating downgrade following the publication of the Medium-Term Fiscal Framework, Banco Popular's Economic Research team asserts that for the past couple of years, investors have been trading Colombian debt as if it were a country with a lower rating than the one currently granted by the major rating agencies.

Additionally, for Henry Amorocho Moreno, professor of Public Finance and Budget at the Faculty of Law at the Universidad del Rosario, the figures revealed by the MFMP confirm that the country is facing an unsustainable fiscal situation, aggravated by structural weaknesses in the tax system and in the management of public spending.

Comparing current projections with estimates made in December 2024 reveals significant changes in revenue calculations, which , according to Professor Henry Amorocho, demonstrate "serious difficulties in the country's tax planning and implementation."

This is an administrative inefficiency in fiscal and tax management.

While the 2026 budget proposal estimates tax revenue at 321.6 trillion pesos, the Ministry of Public Works and Land Management (MFMP) has adjusted it downwards to 281.4 trillion pesos, representing a difference of 40 trillion pesos.

For the academic, this discrepancy is not due to temporary factors, but rather to a persistent structural problem. "This is an administrative inefficiency in fiscal and tax management that must be addressed with fundamental solutions," he warns.

In this regard, it is considered urgent to begin drafting and presenting a structural tax reform project, rather than continuing to resort to short-term reforms, such as the one suggested by the Ministry of Finance on June 13 when it presented the MFMP.

Photo: iStock.

According to the MFMP, the National Government is considering two paths to sustain the increase in revenue in 2026: a tax reform that would raise nearly 19 trillion pesos or a new debt of 38 trillion pesos.

However, even with these measures, the projected increase in tax collection over the next five years is only between 0.4 and 0.9 percent of GDP, which reveals, in the words of the Universidad del Rosario professor, a "low effectiveness in the management of the tax system."

The outlook for public spending is equally worrying. A 2.5 percent reduction in GDP is projected for the next five years, with no structural reform proposals.

A marginal improvement that does not solve the underlying problem

Furthermore, the urgent need for convergence between the new General Participation System, approved in 2024, and the draft Powers Law currently being studied in Congress is not addressed .

Added to this is the forecast debt of 38 trillion pesos in a context where public spending already amounts to 24.4 percent of GDP in 2025. Public debt, meanwhile, would barely decrease from 61 to 60 percent of GDP in five years. "A marginal improvement that doesn't resolve the underlying problem," says Henry Amorocho.

Credit rating agencies have also expressed concern. Fitch Ratings officially warned of Colombia's fiscal deterioration, exacerbated by the government's decision to implement an escape clause that suspends the fiscal rule for three years, raising the deficit from 5.1 to 7.1 percent of GDP.

Germán Ávila, Minister of Finance. Photo: Néstor Gómez, EL TIEMPO

Economic growth is also not conducive to this outlook: GDP is projected to average just 2.8 percent for the next five years, just 0.1 percent above the growth estimated for this year.

For Professor Henry Amorocho, this situation demonstrates that "the current formula—increasing spending, stagnant revenue, and more debt—is not viable and only shifts the problem to future administrations."

Faced with this scenario, the expert emphasizes that the country needs to adopt profound structural changes. This entails a comprehensive tax reform that rigorously and technically reviews the rate structure, tax bases, and exemptions.

It is necessary to end the redundancy of powers and make the use of public resources more efficient.

Regarding spending, he proposes a functional review of the State to identify and eliminate duplication of functions and processes across different state institutions. "It is necessary to end the redundancy of powers and make the use of public resources more efficient," he stated.

It also concludes that a combination of structural tax reform and expenditure reform will allow the country to regain fiscal sustainability, strengthen its economy, and protect the health of its public finances. Only then can it responsibly address the difficult fiscal situation Colombia is currently experiencing.

eltiempo

%3Aformat(jpg)%3Aquality(99)%3Awatermark(f.elconfidencial.com%2Ffile%2Fbae%2Feea%2Ffde%2Fbaeeeafde1b3229287b0c008f7602058.png%2C0%2C275%2C1)%2Ff.elconfidencial.com%2Foriginal%2Fe98%2Fd38%2Fb7a%2Fe98d38b7a595cc2a52dd45ff63912edd.jpg&w=3840&q=100)