Mortgages, fixed or variable rate? How much money from the bank and for how many years? Surrogacy? Answers to the most common questions

To better understand the dynamics of the mortgage sector, Kìron experts (a credit brokerage company of the Tecnocasa Group) conducted a detailed analysis of the “home mortgage” product, taking into consideration indices such as financing purpose, type of rate, duration and average amount of mortgages subscribed through Kìron and Epicas branded agencies in 2024 and comparing them with the previous year.

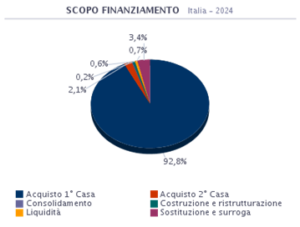

FUNDING PURPOSE

In 2024, purchasing a first home is the main reason for taking out a mortgage and represents 92.8% of all requests . Those who opt for replacement or surrogation represent 3.4%. Debt consolidation operations (with which debts accumulated in the short term are extinguished, replacing them with a new form of financing with a different installment or a different repayment schedule) constitute 0.2%. Those who resort to financing to obtain greater liquidity, for reasons other than those of purchasing a home against financial guarantees, represent 0.7% of the total. The percentage of those who take out a mortgage to build or renovate their home is equal to 0.6%. It is also interesting to analyze how many choose financing to purchase a second home and who constitute 2.1%.

Compared to 2023, we see a growth in the purchase of a second home of +0.4%, replacement and surrogation of +0.9% and a decrease in the purchase of a first home of -1.3%. The other purposes are almost unchanged.

Source: Kiron Partner SpA, Tecnocasa Group

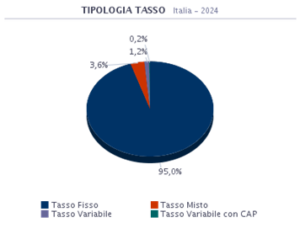

RATE TYPE

The dynamics of the reference indices show rates that have once again reached historically low values and an average product cost (spread) that is lower than in previous years. In this period , 95.0% of borrowers opted for a fixed rate product . The second choice was for the mixed rate product with 3.6% of preferences.

Compared to 2023, we see a growth for fixed rate products of +14.7% and a decrease for variable rate products of -14.8%. The other products are almost unchanged.

Source: Kiron Partner SpA, Tecnocasa Group

Variable rate: instalment linked over time to a reference rate (Euribor or ECB) which increases or decreases the instalment with each positive or negative variation.

Variable rate with CAP: pure variable rate with the option of having a maximum ceiling that cannot be exceeded.

Fixed rate: unchanged instalment as the rate is defined at the time of subscription based on the reference parameter (EurIRS).

Mixed rate: flexible mortgage with the option to switch from a fixed rate to a variable rate instalment or vice versa.

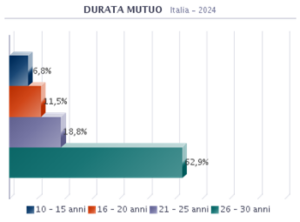

LOAN DURATION

At a national level , the average mortgage duration is 26.6 years, while in the previous year it was 26.7 years . Segmenting by duration range, it emerges that 62.9% of mortgages have a duration between 26 and 30 years. 18.8% are in the 21-25 year range. 11.5% are in the 16-20 year range. 6.8% are in the 10-15 year range.

Average Mortgage Duration: 26.6 years

Source: Kiron Partner SpA, Tecnocasa Group

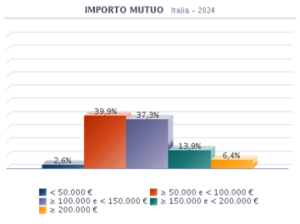

LOAN AMOUNT

In 2024, the average amount of mortgage issued in the country was 119,000 euros, while in the previous year it amounted to 115,400 euros. Dividing the sample by bands of disbursement, we note how the distribution is more unbalanced towards medium-low amounts. 2.6% of mortgages issued have an amount lower than €50,000. 39.9% of mortgages issued have an amount belonging to the band ≥ 50,000 and < €100,000. 37.3% of borrowers obtained financing from €100,000 to €150,000. 13.9%, however, are placed in the next band, ≥ 150,000 and < €200,000. The percentage of mortgages exceeding €200,000 is 6.4%.

Average Mortgage Amount: 119,000 euros

Source: Kiron Partner SpA, Tecnocasa Group

Source: Kìron Partner SpA, Tecnocasa Group

Affari Italiani