Nvidia is back on the scene: It now has a market capitalization greater than the stock markets of Canada and Mexico combined

Nvidia

Nvidia does not stop on the stock exchange . The title of the largest manufacturer of artificial intelligence chips in the world is now worth more than the combined value of the Canadian and Mexican stock markets. The technology company also exceeds the total value of all companies listed on the stock exchange in the United Kingdom . That is 3.92 billion dollars. Nvidia shares reached a record price of 160.98 dollars, giving the company a market capitalization higher than the record value of 3.915 billion dollars reached by Apple on December 26, 2024. Despite the forecasts, therefore, interest in Nvidia chips does not decrease, which continue to obtain very positive results in the training of large artificial intelligence models.

High-end chip sales are being fueled by Microsoft, Amazon, Meta, Alphabet and Tesla’s rush to build AI data centers. Microsoft is currently the second most valuable company on Wall Street, with a market cap of $3.7 billion and shares worth $499.56. Apple is third with a market value of $3.19 billion. INvidia, whose chip technology was developed to power video games, has seen its value grow nearly eightfold in the past four years, from $500 billion in 2021 to nearly $4 trillion.

Nvidia is now trading at about 32 times analysts’ forecast earnings for the next 12 months, below its average of about 41 over the past five years . This relatively modest price-to-earnings valuation reflects the steady rise in earnings estimates.

It is worth noting that the stock is up more than 68% from its recent low on April 4, when Wall Street has been going through a rough patch, shaken by President Donald Trump 's repeated announcements on tariffs. Nvidia represents Wall Street's big bet on the proliferation of generative artificial intelligence technology, which is based on the chipmaker's hardware.

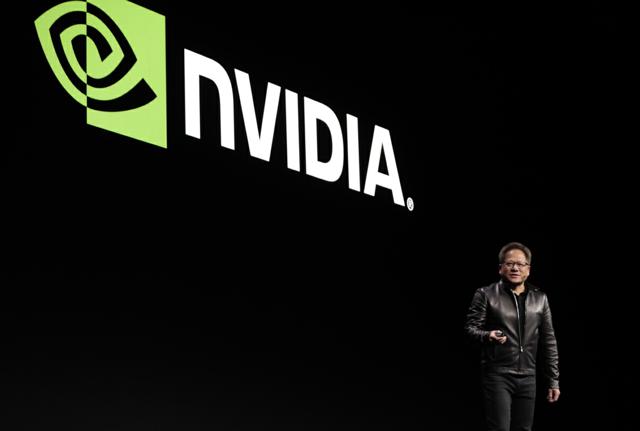

Nvidia, which now makes up 7% of the S&P 500 , was founded in 1993 by Jensen Huang, who has been CEO ever since, and has grown from a niche company known only among video game enthusiasts to Wall Street's leading AI stock. And in November last year, Nvidia took over the Dow Jones from another PC chipmaker, Intel, marking a major shift in the semiconductor industry toward AI-related development and graphics processing hardware that Nvidia pioneered.

Competitors are not lacking, however. Last January, the Chinese startup DeepSeek triggered a series of declines on global stock markets by launching an artificial intelligence model at reduced prices, sparking speculation that companies could spend less on high-end processors such as those from Nvidia, which evidently knows how to resist Chinese attacks.

Affari Italiani