Metallurgical activity fell 1.1% in May and remains far from historical levels.

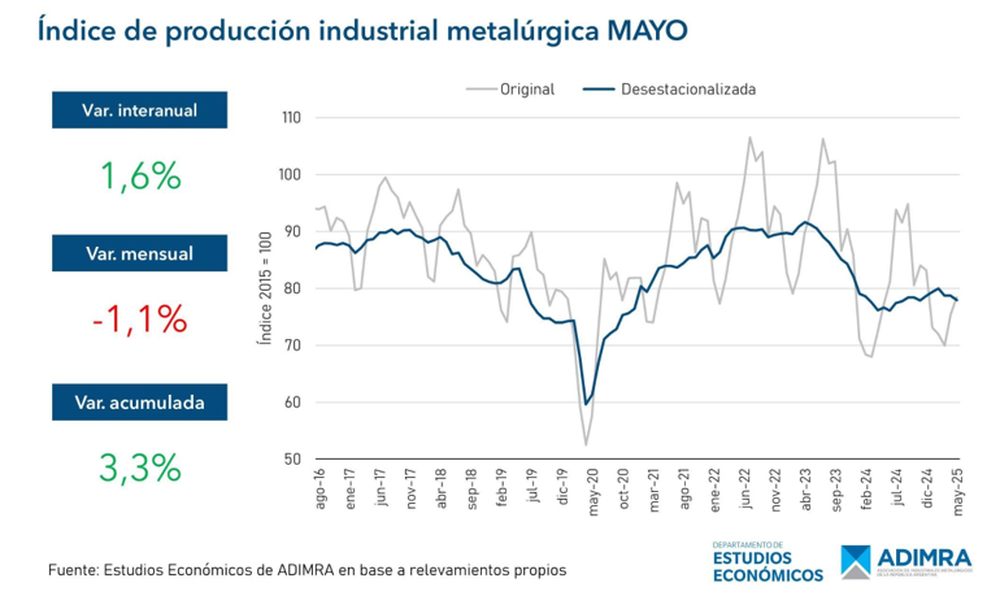

The Argentine metallurgical industry registered a 1.1% decline in May compared to April and a 1.6% year-over-year increase (compared to May 2024). While the year-to-date figure shows a positive change of 3.3% compared to the same period in 2024, production is still 11.7% below the 2023 average and 14.5% below the sector's historical peaks.

On the labor front, the report indicates that, despite the decline in activity, no critical impact on employment has been recorded so far. The year-on-year change in May was -1.9%, and the monthly comparison with April remained stable.

Metallurgical Industry May 2025 Adimra 1.png

Despite signs of recovery, Adimra President Elio Del Re warned that the metallurgical industry is still failing to show sustained growth. “Activity continues to show no significant progress, and imports are growing at an average monthly rate of 4.9%. In particular, capital goods imports are reaching record levels, contrasting with a local industry that is experiencing stagnation and decline in this same segment,” he stated. He added: “All developed countries have a strong metallurgical industry, and Argentina cannot be an exception.”

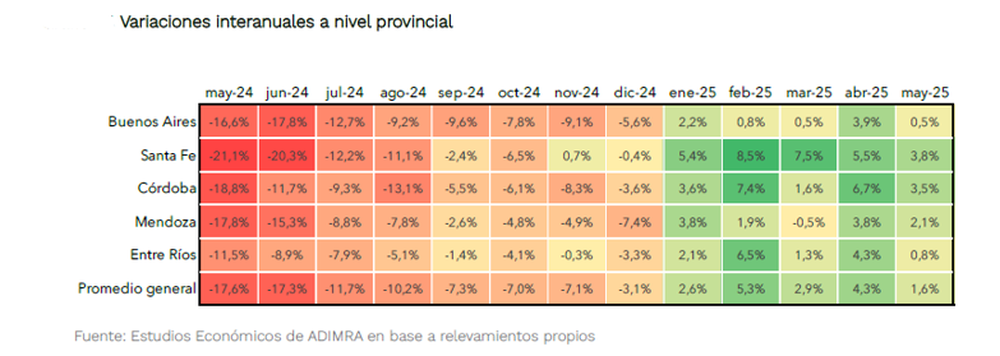

The main metallurgical provinces saw positive year-on-year increases in May, but with less momentum than in previous months. Santa Fe (3.8%) and Córdoba (3.5%) remained among the best performers, driven by agricultural machinery activity. Mendoza (2.1%), Entre Ríos (0.8%), and Buenos Aires (0.5%) also showed improvements, although with a clear slowdown compared to April.

From May to December 2024, metallurgical production in Mendoza experienced declines—very significant in May and June, of 17.8% and 15.3%, respectively—in line with what occurred nationwide. However, at the beginning of 2025, this trend reversed (as also observed in the national average). Thus, in January, it grew 3.8% year-on-year; in February, it grew 1.9%; in March, it fell again, by 0.5%; in April, it recovered by 3.8%, and in May, it increased by 2.1%. However, the comparison is with the same month in 2024, when it had fallen by 17.8%.

The president of the Mendoza Metallurgical Industrialists Association (Asinmet), Fabián Solís , said they are seeing slower recoveries, since public works—which remain at low levels—are important for the metalworking industry, and oil exploitation in mature wells has stopped generating activity for member companies.

"It's important to note that the comparison is made with a period of deep contraction, with a -13.7% drop in activity in the first half of 2024, and an average recovery of 2.25% so far in the first half of 2025," he said.

Metallurgical Industry May 2025 Adimra 3.png

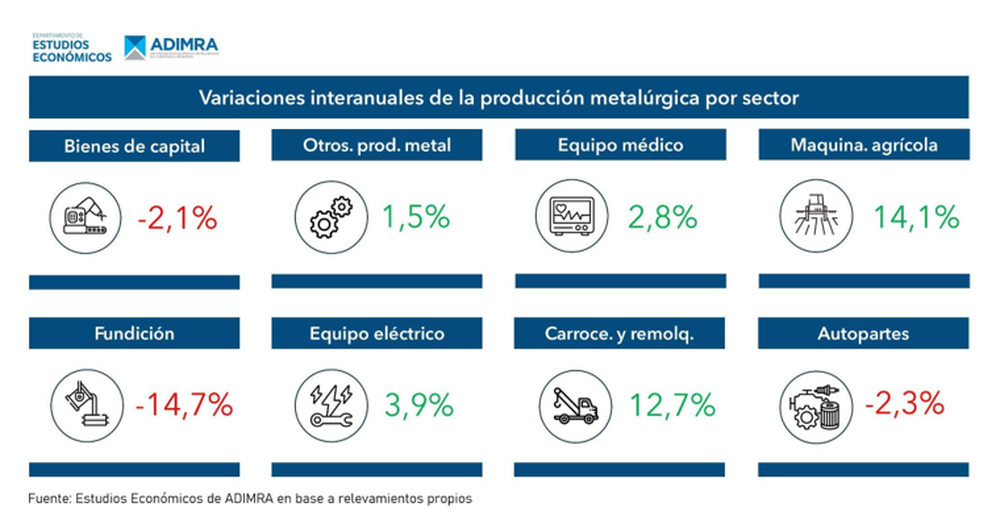

In the analysis by category, a typical trend is repeated: while some segments show signs of recovery, others are experiencing a deeper decline. Agricultural Machinery (14.1%) and Bodywork and Trailers (12.7%) again led year-on-year growth, although with a slowdown compared to April.

In contrast, the Foundry sector fell 14.7% and remains among the hardest hit, with a prolonged contraction and activity at rock-bottom levels. Also notable was the negative performance of Auto Parts, down 2.3%, and the decline in Capital Goods (-2.1%), which had barely managed to remain in positive territory in April.

Other industrial segments, such as Electrical Equipment and Appliances (3.9%), Medical Equipment (2.8%) and Other Metal Products (1.5%), maintained a moderate upward trend in May, in line with the recovery process that some sectors began at the end of last year.

Metallurgical Industry May 2025 Adimra 2.png

Foreign trade again showed imbalances. In April, the latest month for which data is available, exports of metallurgical products totaled US$476 million, a 7.4% increase compared to the same month in 2024.

Imports, on the other hand, grew 29.4% year-on-year and continue to expand at an average monthly rate of 4.9% since June of last year, when foreign purchases had reached their lowest point. Capital goods led this growth, reaching record levels in imported volume.

losandes