The expected decline in loan interest rates has begun: Here are the current interest rates of banks

Banking sources are issuing an important warning to consumers looking to take out a loan during this period: "During this period, when interest rates are on a downward trend, shorter-term, lower-amount loans should be preferred." This way, consumers will not only bear less of the interest burden but also have the opportunity to benefit from expected interest rate reductions in the future.

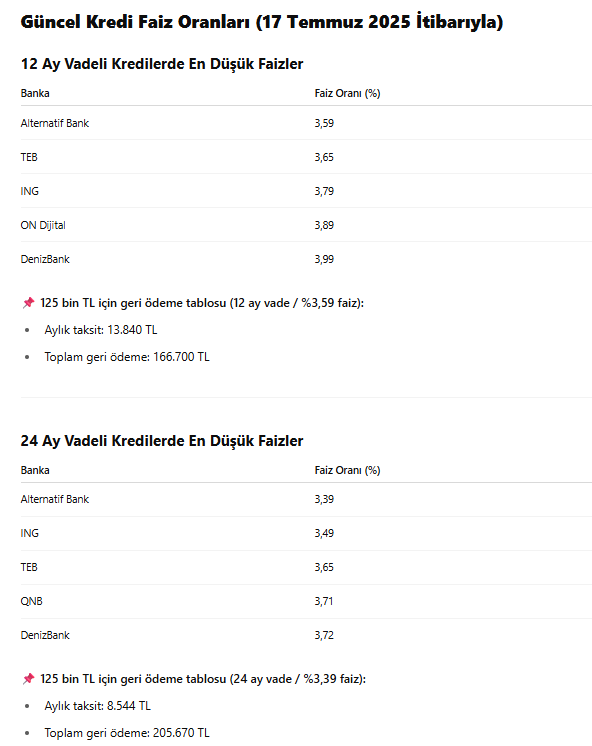

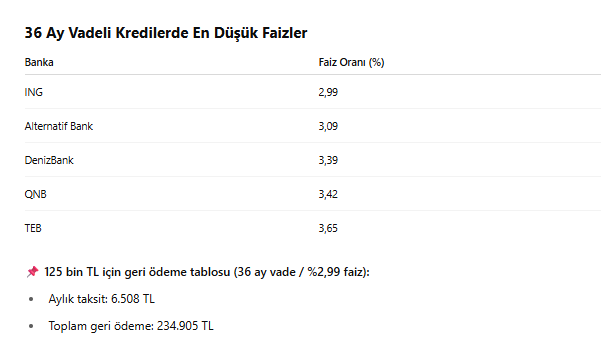

In the short term, the interest rate is higher and the total cost is lower.

In the long run, the interest rate is lower, but the total repayment increases significantly.

For example, while the interest burden for a 12-month loan is around 33%, this rate exceeds 91% in 36 months.

CREDIT VOLUME INCREASESAccording to a report in Türkiye Newspaper, according to BRSA data, the total volume of personal consumer loans reached 1.736 billion 532 million Turkish Lira during the week of July 4th. This increase of approximately 10 billion Turkish Lira in one week demonstrates continued consumer demand.

ATTENTION TO THOSE PLANNING TO GET A LOAN!If interest rate cuts continue in the coming days, it might be a wise move to get through the current period with short-term, low-amount loans. This will both reduce the interest burden and open up space for new opportunities.

SÖZCÜ