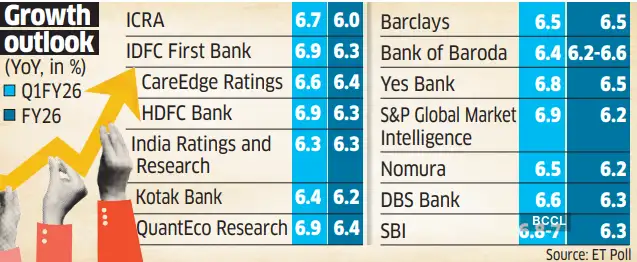

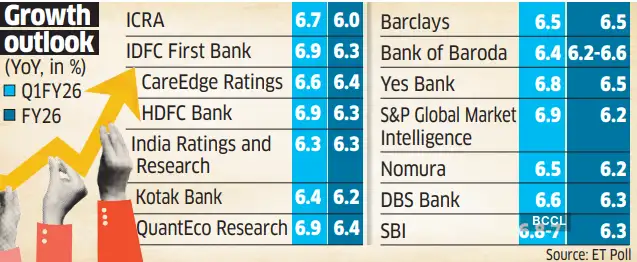

GDP growth in Q1 projected at 6.7% on strong govt capex, rural demand

Strong government expenditure, strengthening rural demand, and buoyant services industry supported India’s economic growth to a median of 6.7% in the first quarter of FY26, according to an ET poll of 14 economists. The growth estimates range from 6.3% to 7%, aligning with the Reserve Bank of India projection of 6.5%. India’s gross domestic product (GDP) grew by 6.5% in the first quarter of last fiscal year. The National Statistics Office (NSO) will release the official GDP figures for the April-June quarter on August 29. The government’s capital expenditure rose by 52% year-on-year in Q1.  Construction & farm sectors keyAviation cargo traffic, goods and services tax (GST) collection, and steel production also recorded growth. “GDP growth is expected to be supported by robust public spending, improving rural demand, and a resilient services sector,” said Rajani Sinha, chief economist, CareEdge Ratings. “Construction and agriculture are two sectors where we have accounted for higher growth,” said Sakshi Gupta, principal economist at HDFC Bank. Exports of goods and services rose by 5.9% in the June quarter. “This was aided by frontloaded demand from economies like the US,” said Gupta. However, the pace of growth in Q1 likely moderated from 7.4% in the March quarter, hindered by weakness in mining and manufacturing sectors. “Global trade policy uncertainties and ongoing geopolitical tensions continue to weigh on the manufacturing sector, while the mining sector feels the brunt of early onset of monsoon,” said Sinha. “Indicators such as power supply and coal production contracted in Q1, and air passenger traffic, cement production, steel consumption, and port cargo traffic were the key laggards,” said Aastha Gudwani, India chief economist at Barclays.Industrial activity, measured by the Index of Industrial Production (IIP), grew 2% in Q1FY26 compared to 5.4% a year earlier, while manufacturing output fell to 3.4% from 4.2%. “The GDP growth in Q1 would be impacted by the weak industrial sector growth (due to climate change-led unseasonal rains) and cautious investment demand owing to geopolitical and trade tensions,” said Paras Jasrai, associate director, India Ratings & Research. “The slowdown in growth from the previous quarter was due to a likely slowdown in fixed investment growth —as private sector investment remains muted amid the prevailing global trade policy uncertainty — and a muted growth in private consumption,” said Hanna Luchnikava-Schorsch, head of Asia-Pacific Economics at S&P Global Market Intelligence.GST boot to local demandLooking ahead, India’s GDP for FY26 is estimated to grow by a median of 6.3%, slightly below the RBI’s projection of 6.5%. The estimates range from 6% to 6.6%.“Growth will be supported by recent interest rate cuts, strong agricultural activity boosting rural demand, benign inflationary conditions, and a favourable monsoon,” said Sinha. Further, domestic demand is set to get a boost following the GST rationalisation, said economists.The six-member Group of Ministers (GoM) on GST rate rationalisation Thursday approved the Centre’s proposal to eliminate the 12% and 28% slabs, consolidating the GST structure into two rates — 5% and 18%. This shift from the existing four-slab structure is expected to spur consumer demand in the second half of FY26, potentially adding 20 basis points to annual GDP growth, according to HDFC Bank. Global risksHowever, risks from global trade tensions remain significant. The US has imposed a 50% tariff on Indian imports, including a 25% penalty for importing oil from Russia. “We estimate a 30 bps impact of US tariffs on India’s growth for the full year, in case the current 25% tariff rates stick (we expect them to be eventually lowered following trade discussions with the US),” said Gudwani. HDFC Bank also expects a 20-25 bps risk to GDP growth if the 25% tariff persists. “On the domestic front, subdued income growth in the formal sector and muted hiring in IT remain concerns for urban consumption, even as rural demand holds steady,” said Sinha. The World Bank and International Monetary Fund (IMF) pegged India’s FY26 growth at 6.3% and 6.4%, respectively. As per their estimates, India remains one of the world’s fastest-growing economies. Despite these headwinds, analysts believe India’s strong domestic demand will help cushion the impact of external shocks.“Overall, given the relatively closed nature of the Indian economy wherein domestic demand is the mainstay of growth, we do not see this 25% tariff threat impacting GDP growth meaningfully,” said Gudwani.

Construction & farm sectors keyAviation cargo traffic, goods and services tax (GST) collection, and steel production also recorded growth. “GDP growth is expected to be supported by robust public spending, improving rural demand, and a resilient services sector,” said Rajani Sinha, chief economist, CareEdge Ratings. “Construction and agriculture are two sectors where we have accounted for higher growth,” said Sakshi Gupta, principal economist at HDFC Bank. Exports of goods and services rose by 5.9% in the June quarter. “This was aided by frontloaded demand from economies like the US,” said Gupta. However, the pace of growth in Q1 likely moderated from 7.4% in the March quarter, hindered by weakness in mining and manufacturing sectors. “Global trade policy uncertainties and ongoing geopolitical tensions continue to weigh on the manufacturing sector, while the mining sector feels the brunt of early onset of monsoon,” said Sinha. “Indicators such as power supply and coal production contracted in Q1, and air passenger traffic, cement production, steel consumption, and port cargo traffic were the key laggards,” said Aastha Gudwani, India chief economist at Barclays.Industrial activity, measured by the Index of Industrial Production (IIP), grew 2% in Q1FY26 compared to 5.4% a year earlier, while manufacturing output fell to 3.4% from 4.2%. “The GDP growth in Q1 would be impacted by the weak industrial sector growth (due to climate change-led unseasonal rains) and cautious investment demand owing to geopolitical and trade tensions,” said Paras Jasrai, associate director, India Ratings & Research. “The slowdown in growth from the previous quarter was due to a likely slowdown in fixed investment growth —as private sector investment remains muted amid the prevailing global trade policy uncertainty — and a muted growth in private consumption,” said Hanna Luchnikava-Schorsch, head of Asia-Pacific Economics at S&P Global Market Intelligence.GST boot to local demandLooking ahead, India’s GDP for FY26 is estimated to grow by a median of 6.3%, slightly below the RBI’s projection of 6.5%. The estimates range from 6% to 6.6%.“Growth will be supported by recent interest rate cuts, strong agricultural activity boosting rural demand, benign inflationary conditions, and a favourable monsoon,” said Sinha. Further, domestic demand is set to get a boost following the GST rationalisation, said economists.The six-member Group of Ministers (GoM) on GST rate rationalisation Thursday approved the Centre’s proposal to eliminate the 12% and 28% slabs, consolidating the GST structure into two rates — 5% and 18%. This shift from the existing four-slab structure is expected to spur consumer demand in the second half of FY26, potentially adding 20 basis points to annual GDP growth, according to HDFC Bank. Global risksHowever, risks from global trade tensions remain significant. The US has imposed a 50% tariff on Indian imports, including a 25% penalty for importing oil from Russia. “We estimate a 30 bps impact of US tariffs on India’s growth for the full year, in case the current 25% tariff rates stick (we expect them to be eventually lowered following trade discussions with the US),” said Gudwani. HDFC Bank also expects a 20-25 bps risk to GDP growth if the 25% tariff persists. “On the domestic front, subdued income growth in the formal sector and muted hiring in IT remain concerns for urban consumption, even as rural demand holds steady,” said Sinha. The World Bank and International Monetary Fund (IMF) pegged India’s FY26 growth at 6.3% and 6.4%, respectively. As per their estimates, India remains one of the world’s fastest-growing economies. Despite these headwinds, analysts believe India’s strong domestic demand will help cushion the impact of external shocks.“Overall, given the relatively closed nature of the Indian economy wherein domestic demand is the mainstay of growth, we do not see this 25% tariff threat impacting GDP growth meaningfully,” said Gudwani.

Construction & farm sectors keyAviation cargo traffic, goods and services tax (GST) collection, and steel production also recorded growth. “GDP growth is expected to be supported by robust public spending, improving rural demand, and a resilient services sector,” said Rajani Sinha, chief economist, CareEdge Ratings. “Construction and agriculture are two sectors where we have accounted for higher growth,” said Sakshi Gupta, principal economist at HDFC Bank. Exports of goods and services rose by 5.9% in the June quarter. “This was aided by frontloaded demand from economies like the US,” said Gupta. However, the pace of growth in Q1 likely moderated from 7.4% in the March quarter, hindered by weakness in mining and manufacturing sectors. “Global trade policy uncertainties and ongoing geopolitical tensions continue to weigh on the manufacturing sector, while the mining sector feels the brunt of early onset of monsoon,” said Sinha. “Indicators such as power supply and coal production contracted in Q1, and air passenger traffic, cement production, steel consumption, and port cargo traffic were the key laggards,” said Aastha Gudwani, India chief economist at Barclays.Industrial activity, measured by the Index of Industrial Production (IIP), grew 2% in Q1FY26 compared to 5.4% a year earlier, while manufacturing output fell to 3.4% from 4.2%. “The GDP growth in Q1 would be impacted by the weak industrial sector growth (due to climate change-led unseasonal rains) and cautious investment demand owing to geopolitical and trade tensions,” said Paras Jasrai, associate director, India Ratings & Research. “The slowdown in growth from the previous quarter was due to a likely slowdown in fixed investment growth —as private sector investment remains muted amid the prevailing global trade policy uncertainty — and a muted growth in private consumption,” said Hanna Luchnikava-Schorsch, head of Asia-Pacific Economics at S&P Global Market Intelligence.GST boot to local demandLooking ahead, India’s GDP for FY26 is estimated to grow by a median of 6.3%, slightly below the RBI’s projection of 6.5%. The estimates range from 6% to 6.6%.“Growth will be supported by recent interest rate cuts, strong agricultural activity boosting rural demand, benign inflationary conditions, and a favourable monsoon,” said Sinha. Further, domestic demand is set to get a boost following the GST rationalisation, said economists.The six-member Group of Ministers (GoM) on GST rate rationalisation Thursday approved the Centre’s proposal to eliminate the 12% and 28% slabs, consolidating the GST structure into two rates — 5% and 18%. This shift from the existing four-slab structure is expected to spur consumer demand in the second half of FY26, potentially adding 20 basis points to annual GDP growth, according to HDFC Bank. Global risksHowever, risks from global trade tensions remain significant. The US has imposed a 50% tariff on Indian imports, including a 25% penalty for importing oil from Russia. “We estimate a 30 bps impact of US tariffs on India’s growth for the full year, in case the current 25% tariff rates stick (we expect them to be eventually lowered following trade discussions with the US),” said Gudwani. HDFC Bank also expects a 20-25 bps risk to GDP growth if the 25% tariff persists. “On the domestic front, subdued income growth in the formal sector and muted hiring in IT remain concerns for urban consumption, even as rural demand holds steady,” said Sinha. The World Bank and International Monetary Fund (IMF) pegged India’s FY26 growth at 6.3% and 6.4%, respectively. As per their estimates, India remains one of the world’s fastest-growing economies. Despite these headwinds, analysts believe India’s strong domestic demand will help cushion the impact of external shocks.“Overall, given the relatively closed nature of the Indian economy wherein domestic demand is the mainstay of growth, we do not see this 25% tariff threat impacting GDP growth meaningfully,” said Gudwani.

Construction & farm sectors keyAviation cargo traffic, goods and services tax (GST) collection, and steel production also recorded growth. “GDP growth is expected to be supported by robust public spending, improving rural demand, and a resilient services sector,” said Rajani Sinha, chief economist, CareEdge Ratings. “Construction and agriculture are two sectors where we have accounted for higher growth,” said Sakshi Gupta, principal economist at HDFC Bank. Exports of goods and services rose by 5.9% in the June quarter. “This was aided by frontloaded demand from economies like the US,” said Gupta. However, the pace of growth in Q1 likely moderated from 7.4% in the March quarter, hindered by weakness in mining and manufacturing sectors. “Global trade policy uncertainties and ongoing geopolitical tensions continue to weigh on the manufacturing sector, while the mining sector feels the brunt of early onset of monsoon,” said Sinha. “Indicators such as power supply and coal production contracted in Q1, and air passenger traffic, cement production, steel consumption, and port cargo traffic were the key laggards,” said Aastha Gudwani, India chief economist at Barclays.Industrial activity, measured by the Index of Industrial Production (IIP), grew 2% in Q1FY26 compared to 5.4% a year earlier, while manufacturing output fell to 3.4% from 4.2%. “The GDP growth in Q1 would be impacted by the weak industrial sector growth (due to climate change-led unseasonal rains) and cautious investment demand owing to geopolitical and trade tensions,” said Paras Jasrai, associate director, India Ratings & Research. “The slowdown in growth from the previous quarter was due to a likely slowdown in fixed investment growth —as private sector investment remains muted amid the prevailing global trade policy uncertainty — and a muted growth in private consumption,” said Hanna Luchnikava-Schorsch, head of Asia-Pacific Economics at S&P Global Market Intelligence.GST boot to local demandLooking ahead, India’s GDP for FY26 is estimated to grow by a median of 6.3%, slightly below the RBI’s projection of 6.5%. The estimates range from 6% to 6.6%.“Growth will be supported by recent interest rate cuts, strong agricultural activity boosting rural demand, benign inflationary conditions, and a favourable monsoon,” said Sinha. Further, domestic demand is set to get a boost following the GST rationalisation, said economists.The six-member Group of Ministers (GoM) on GST rate rationalisation Thursday approved the Centre’s proposal to eliminate the 12% and 28% slabs, consolidating the GST structure into two rates — 5% and 18%. This shift from the existing four-slab structure is expected to spur consumer demand in the second half of FY26, potentially adding 20 basis points to annual GDP growth, according to HDFC Bank. Global risksHowever, risks from global trade tensions remain significant. The US has imposed a 50% tariff on Indian imports, including a 25% penalty for importing oil from Russia. “We estimate a 30 bps impact of US tariffs on India’s growth for the full year, in case the current 25% tariff rates stick (we expect them to be eventually lowered following trade discussions with the US),” said Gudwani. HDFC Bank also expects a 20-25 bps risk to GDP growth if the 25% tariff persists. “On the domestic front, subdued income growth in the formal sector and muted hiring in IT remain concerns for urban consumption, even as rural demand holds steady,” said Sinha. The World Bank and International Monetary Fund (IMF) pegged India’s FY26 growth at 6.3% and 6.4%, respectively. As per their estimates, India remains one of the world’s fastest-growing economies. Despite these headwinds, analysts believe India’s strong domestic demand will help cushion the impact of external shocks.“Overall, given the relatively closed nature of the Indian economy wherein domestic demand is the mainstay of growth, we do not see this 25% tariff threat impacting GDP growth meaningfully,” said Gudwani.economictimes