IMF head says Canada has fiscal wiggle room as larger deficit looms

The head of the International Monetary Fund (IMF) says Canada is in one of the better fiscal positions among the G7 nations — even though the Liberal government is set to run a higher deficit this year.

IMF Managing Director Kristalina Georgieva was asked about the fiscal health of the world’s advanced economies during a press briefing at the IMF’s annual meeting in Washington on Thursday.

“Some have a more significant fiscal problem. Others less…. we have countries in the G7 that are in a better position. Germany and Canada stand up in that regard,” Georgieva said in response.

Georgieva went on to suggest that Canada should use the fiscal wiggle room it has to spur growth as the global economy faces some headwinds.

“The areas that Canada identified — housing, infrastructure, energy — they are thinking of some strategic projects. These are areas that we see the need of doing more, so Canada can lift up productivity,” she said.

The IMF released a report earlier this week that projected global growth will slow from 3.3 per cent in 2024 to 3.2 per cent in 2025 and 3.1 per cent in 2026.

“Prolonged uncertainty, more protectionism and labour supply shocks could reduce growth. Fiscal vulnerabilities, potential financial market corrections and erosion of institutions could threaten stability,” the report said.

Canada has been hit hard by many of U.S. President Donald Trump's tariffs and the IMF projected its growth this year would slow to 1.2 per cent.

The Liberal government is set to table its budget on Nov. 4, the first under Prime Minister Mark Carney.

Carney and the Liberals were elected in April after promising to emphasize “nation-building projects” as part of its response to Trump’s tariffs. Carney has also promised to hit the NATO defence spending target of two per cent of GDP in 2026.

As a result, the prime minister has signalled that the deficit will be larger than in the previous year.

The Parliamentary Budget Officer (PBO) released a report last month forecasting that the government will post an annual deficit of $68.5 billion this year, up from $51.7 billion last year.

But contrary to Georgieva comments on Canada’s fiscal position, interim PBO Jason Jacques recently described the state of Canada's finances as "stupefying," "shocking" and "unsustainable."

"I think everybody should be concerned," Jacques told MPs on the government operations and estimates committee last month.

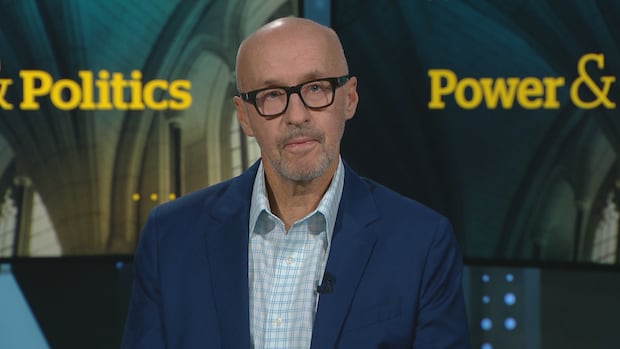

One of Jacques’s predecessors, Kevin Page, has publicly disputed the interim PBO’s assessment of Canada’s fiscal health.

"I think the language from the current parliamentary budget officer, Mr. Jason Jacques, is just wrong and he should walk that back, quite frankly," the former PBO told CBC’s Power & Politics in an interview earlier this month.

Page didn't disagree with the numbers in the recent PBO report, but argued Canada is fiscally "in a pretty good place" relative to other G7 countries.

"It's not shocking to see a deficit go up because the economy is slowing and we have NATO commitments. To me, it's sustainable," Page said.

The Liberals recently announced that the government is changing its budgetary cycle and will present all future budgets in the fall rather than the spring. The Liberals will also separate day-to-day operational spending from capital investments — and are promising to balance the operational expenses within three years.

Finance Canada is defining capital investment “as any government expense or tax expenditure that contributes to public or private sector capital formation, held directly on the government's balance sheet or on that of a private sector entity, Indigenous community or another level of government."

While some, including the PBO, have suggested that definition is too broad, the IMF's Georgieva said the new budgetary framework is a “welcome” change.

“They are moving the cycle in a way that we think is appropriate,” she said Thursday.

cbc.ca