13F reports: A look at the cards of the big players

It's almost that time again when Wall Street's big players will have to disclose their transactions. This also presents opportunities for private investors, because with the right evaluation and analysis, they can draw solid conclusions about who the high-flyers of tomorrow will be.

The last few months on the financial markets have been a tough one: US tariffs, an escalating trade war, and almost daily – sometimes even multiple – updates from the White House have left investors sweating. The policies of incumbent US President Donald Trump in his second term can probably be best described in one word: fickle. Keeping a cool head is therefore anything but easy at the moment. This makes the question of how the big players – the world's largest investors, banks, hedge funds, and family offices – have reacted to the constantly changing conditions and where they have invested their capital during this time all the more fascinating. May 15th is that time again: the deadline for Wall Street's elite to disclose their investments of the past three months is approaching. All transactions must be submitted to the US financial regulator, the Securities and Exchange Commission (SEC), by this date. This mandatory event takes place four times a year and provides private investors in particular with an insightful look at which companies the professionals are betting on.

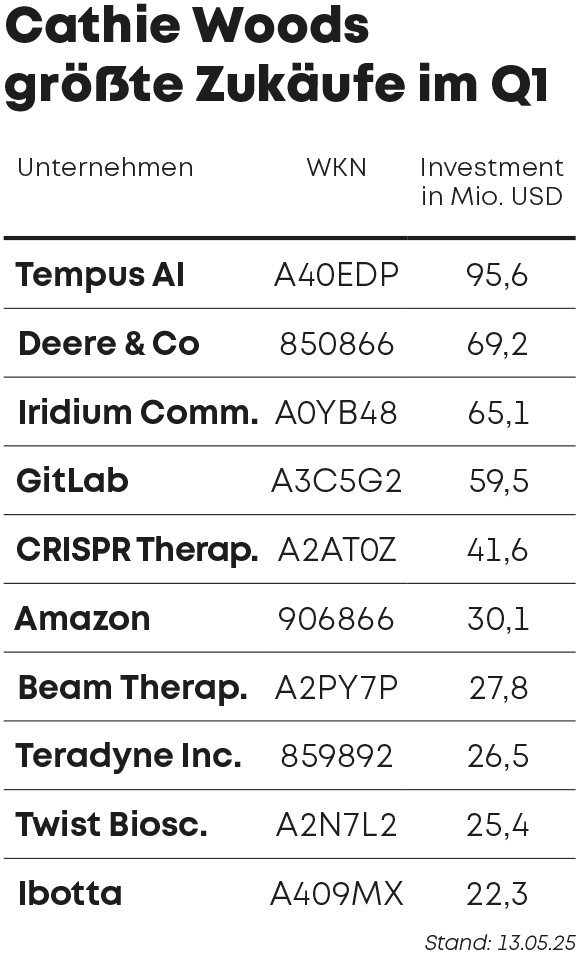

Although the deadline is just before the weekend, the first investors have already submitted their documents in exemplary fashion – including Ark Invest, Cathie Wood's investment company. The economist is primarily known for her focus on disruptive technology companies. True to the motto "Invest in tomorrow's future – today," she focuses on topics such as artificial intelligence, electromobility, blockchain and cryptocurrencies, genome research, as well as robotics and automation – which is clearly reflected in her portfolio.

In the last quarter alone, Wood invested approximately $96 million in the health technology company Tempus AI—her largest investment in the first quarter of the year—bringing her total stake in the company to approximately $362 million. Following in second and third place among the largest acquisitions were agricultural equipment manufacturer Deere & Co., with nearly $70 million, and an investment of approximately $65 million in satellite operator Iridium Communications.

SEC filings reveal not only where the big players are investing their capital, but also where funds have been withdrawn. This can be an indication that the big players have lost confidence in a company. But it could just as easily mean that they were simply cashing in. For example, Cathie Wood sold Tesla shares worth $7.4 million last quarter. Nevertheless, the electric car manufacturer remains the top holding in the Ark Invest portfolio, with a portfolio value of $844 million.

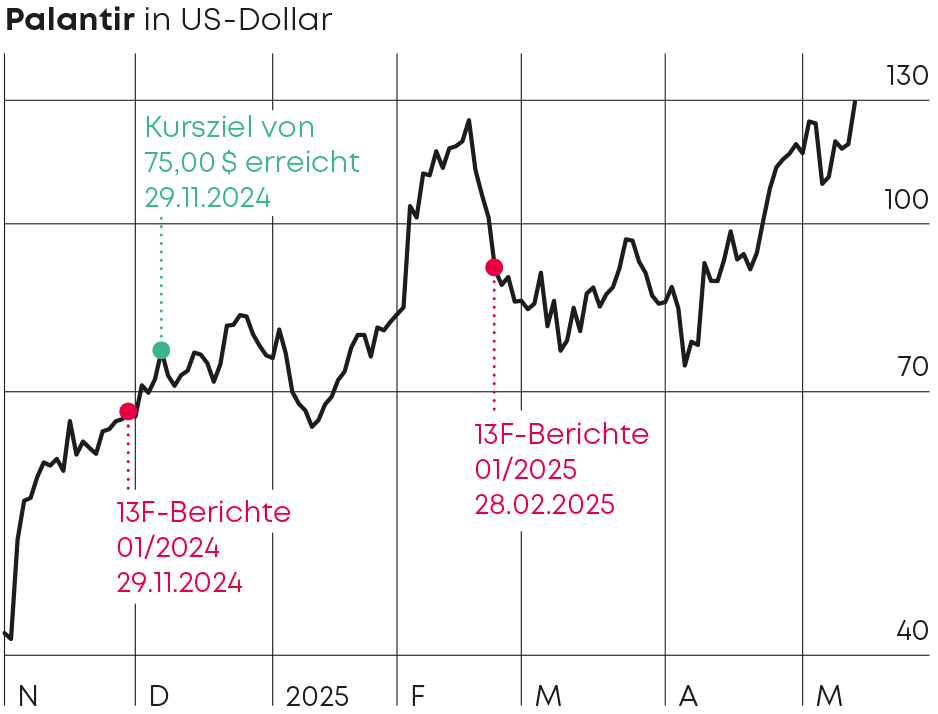

AKTIONÄR reader favorite Palantir was also on the sales list at €127.3 million. Nevertheless, the AI data specialist remains among the top three positions at Ark Invest.

That Palantir is one of the darlings of the Wall Street elite was already evident in the SEC filings at the end of 2024. As reported in the stock newsletter 13F-Berichte (issue 01/2024), the stock was among the absolute top 50 picks – out of over 16,500 analyzed stocks. Authors Steffen Härtlein and Golo Kirchhoff analyzed the stock in detail. Their then-announced price target of $75 was significantly exceeded within just six months – as the current price of $129 impressively demonstrates.

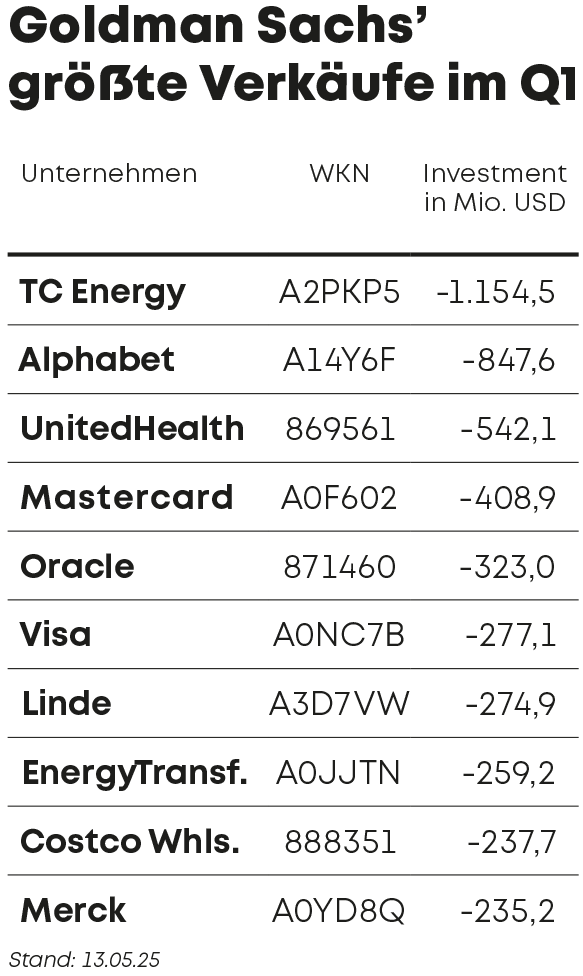

Investments of $90 or $100 million may seem like gigantic sums to the average consumer—but for the big players, the banks, they're little more than peanuts. They think on a completely different scale.

When a bank invests, it does so well: For example, the US investment bank Goldman Sachs has poured over $550 million into AbbVie in the past three months – increasing its total investment to over $900 million. A similar amount flowed into Datadog: a whopping $750 million. Yet, in these circles, such sums are considered merely "medium-sized investments."

You can find out which positions currently carry the greatest weight at the top 10 banks and which stocks have made it into the 50 most promising in the upcoming issue of the 13F reports – on May 27, 2025. Further information is available at www.13f-berichte.de .

This article appeared in DER AKTIONÄR No. 21/2025, which you can download in full as a PDF here .

For more information on 13F reports , click here .

Note on conflicts of interest:

The board member and majority shareholder of the publisher Börsenmedien AG, Mr. Bernd Förtsch, has directly and indirectly entered into positions in the following financial instruments or derivatives related to them mentioned in the publication, which may benefit from any price development resulting from the publication: Palantir.

deraktionaer.de