DAX firm, silver higher: Big decline, Nvidia, Intel, DHL, Rheinmetall, Airbus, SAP, BASF in focus

The DAX showed its strength on Thursday, closing with a 1.4 percent gain at 23,674.53 points. It's likely to rise a few more points at the start of Friday. Broker IG is pricing the German leading index at 23,680 points this morning.

However, there could be some major moves today. September 19th is a major expiration day (witching day) on the stock market, as it coincides with the expiration of stock options, index options, and index futures. Otherwise, the futures side is relatively quiet at the end of the week.

In any case, Nvidia and Intel shares are likely to remain in the spotlight. It was recently announced that Nvidia is buying shares worth five billion dollars. In Germany, the focus is likely to be on Ströer and Stabilus. The advertising marketer Ströer has lowered its forecast, and the automotive supplier Stabilus has announced a cost-cutting program. Scout24 is likely to be in the spotlight following the announcement of the acquisition of the Spanish online real estate platforms Fotocasa and Habitaclia. DHL Group shares are likely to benefit from a strong quarterly report from US competitor FedEx.

In addition, some analyst estimates could cause some movement. Goldman Sachs has added Renk to its rating with a "Neutral" rating and a price target of €70. Goldman is more optimistic about Rheinmetall. The stock is now on the US bank's recommendation list with a "Buy" rating and a price target of €2,200. Goldman Sachs also has high hopes for Airbus. The stock has been reinstated with a "Buy" rating and a price target of €230.

Investors should also continue to keep an eye on the top winners and losers in the DAX from the previous day. SAP, Zalando, Commerzbank, Siemens Energy, and Sartorius performed particularly well here. Beiersdorf, VW, Porsche SE, RWE, and BASF, on the other hand, were at the bottom of the DAX.

Gold, silver, and Bitcoin are stable at high levels at the end of the week. A troy ounce of gold is trading at $3,656 on Friday morning, and a troy ounce of silver at $42.22. One Bitcoin currently costs $116,966.

US stock markets performed favorably on Thursday. The leading Dow Jones Industrial index gained 0.3 percent to 46,142.42 points. The broad-based S&P 500 gained 0.5 percent to 6,631.96 points. The tech-heavy Nasdaq 100 recorded a gain of one percent to 24,454.89 points.

The major Asian markets showed little movement on Friday morning. Japan's Nikkei 225 index recently lost 0.4 percent. The Hang Seng index in the Chinese special administrative region of Hong Kong is currently down 0.2 percent. The CSI 300, which tracks the most important mainland Chinese stocks, is up 0.1 percent.

DER AKTIONÄR will report on all important developments and news on the national and international markets throughout the day.

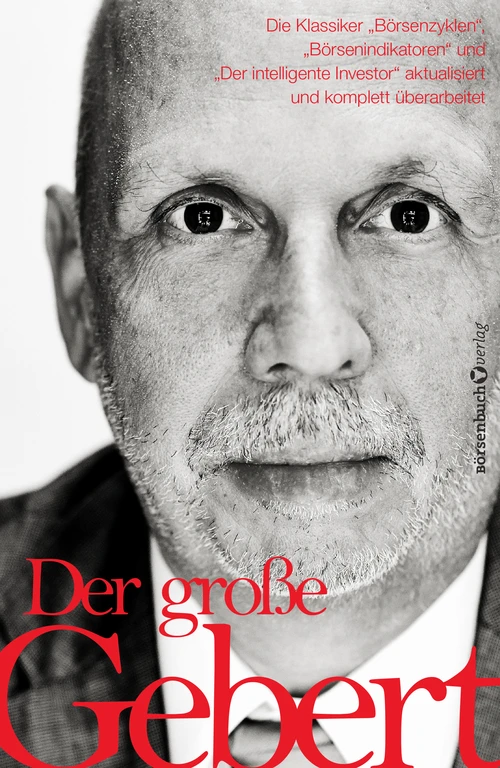

"The Intelligent Investor," "Stock Market Indicators," and "Stock Market Cycles" are classics of stock market literature. Their author is Thomas Gebert, a physicist who has been extraordinarily successful on the stock market for many decades. His "Gebert Stock Market Indicator" has impressed experts for years with its simplicity and outperformance. Now, Thomas Gebert has completely revised his three bestsellers, adapted them to today's situation, and added current examples. "The Great Gebert" is a concentrated source of stock market knowledge that guides readers on how to operate objectively, calmly, and extremely successfully in the markets.

deraktionaer.de