Vonovia at the bottom of the DAX: Justifiably disappointed?

With a daily loss of 2.8 percent, Vonovia ranked last in Germany's leading index in yesterday's trading. Apparently, the Bochum-based housing group failed to impress investors with its capital markets day the previous day. Instead of renewed momentum, the markets reacted with disillusionment. Rightly so?

Vonovia presented its targets for the coming years at a capital markets day on Tuesday (DER AKTIONÄR reported). Analysts do not share the markets' skepticism: Warburg Research was quite impressed by the capital markets day and praised the targets through 2028 as convincing. According to analyst Simon Stippig, there is no reason to doubt that they will be achieved. The buy recommendation with a price target of €38.60 was confirmed.

Berenberg analyst Kai Klose also acknowledged Vonovia's successful presentation—in particular, the planned expansion of its non-rental-related business areas provides growth potential. The price target of €41 and the "Buy" rating remained unchanged.

UBS also expressed a positive opinion: The strategic restructuring is noticeably gaining momentum under new leadership, according to analyst Charles Boissier. The new management is making progress with the strategic restructuring more quickly than slowly. Furthermore, management is confident about recurring revenues and rental income. Here, too, the recommendation is a buy – with a price target of €38.

Things are now getting exciting from a technical perspective. The important €30.00 mark has been broken again. The battle for the moving averages is underway. The 50-day moving average (MA) is at €29.23, slightly below yesterday's closing price of €29.37. The same applies to the 200-day moving average (MA), which is currently at €29.17. There's still some room to move up to the 100-day moving average (€28.16). Overall, the chart picture remains slightly positive despite the breach of the €30 mark.

Yesterday's share price losses at Vonovia are incomprehensible. The company reaffirmed at its Capital Markets Day that its fundamental turnaround is on track. Vonovia even plans to resume construction immediately. The stock remains a buy. Find out whether it will also be one of the top favorites for the second half of the year in the e-paper of the new issue of DER AKTIONÄR .

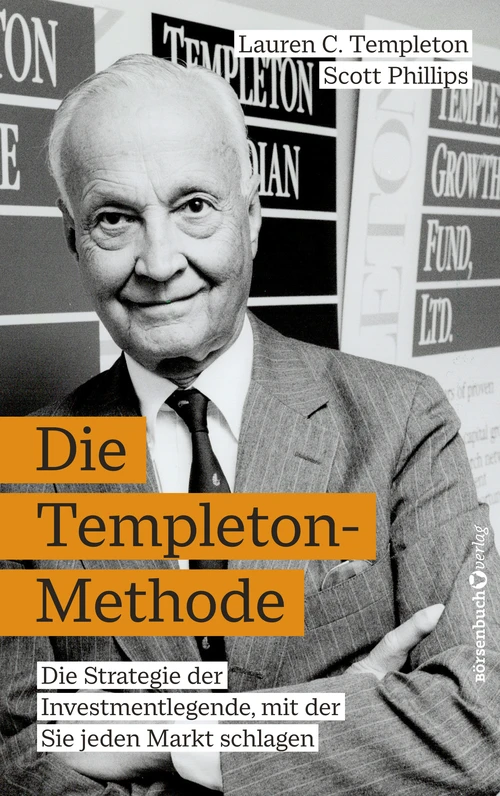

Legendary fund manager Sir John Templeton is considered one of the pioneers of value investing, consistently outperforming the market for five decades. After reading this book, readers will gain a completely new perspective on Sir John Templeton's timeless principles and methods. The book introduces them step by step to the stock market pro's tried-and-tested investment strategies. They learn the methods Templeton used to select his investments, and numerous past examples provide insight into Sir John's approach and his most successful trades. In these volatile times, investors can now more than ever incorporate Templeton's ideas into their own strategies and thus operate profitably in the financial markets.

deraktionaer.de