Weak Wall Street: Alibaba and Palantir slump – Nvidia in focus

There was no major recovery on the US stock markets. The Dow Jones did manage to save a small gain at the end of trading. However, both the S&P 500 and the Nasdaq computer exchange slipped into the red. The leading index Dow Jones climbed marginally by 0.08 percent to 43,461.21 points. This meant that it could barely make up any ground after a loss of 1.7 percent on Friday. This was the Dow's biggest daily loss since mid-December last year.

The broad-based S&P 500 closed 0.50 percent lower on Monday at 5,983.25 points, falling below 6,000 points for the first time in almost three weeks. The Nasdaq 100 extended Friday's two percent loss by 1.21 percent to 21,352.08 points. The index, dominated by tech giants, fell to its lowest level in almost three weeks.

Now the focus is likely to be on the business figures of the semiconductor giant Nvidia, which will be published on Wednesday after the stock market closes. In the run-up to the release, Nvidia shares fell by a good 3 percent on Monday. The stock had already lost four percent on Friday. Stock market traders see the Nvidia figures as an important test of what will happen next with the "Magnificent 7", the seven US giants in the technology sector.

Berkshire Hathaway's B shares rose by a good 4 percent. The investment conglomerate of the well-known investor Warren Buffett presented its business figures at the weekend and reported a jump in profits for the fourth quarter. Berkshire Hathaway is worth around one trillion US dollars on the stock market, making it one of the most valuable US companies after the "Magnificent 7".

Nike shares, the leader in the Dow, recorded an increase of almost five percent. The bank Jefferies recommended buying the lifestyle group's shares and called them the new "top pick".

Shares in Tesla competitor Rivian fell by almost 8 percent. The electric car manufacturer had already disappointed investors on Friday with its forecast for vehicle deliveries. As a result, Bank of America has now downgraded the shares to "underperform."

The New York-listed shares of the Chinese online retail group Alibaba fell by a good 10 percent. Investors were worried about an escalation of the US-China trade dispute. Alibaba shares had also risen sharply in recent weeks.

Shares in data analysis provider Palantir extended their recent losses by 10.5 percent. The market fears that spending cuts by US Secretary of Defense Pete Hegseth could reduce Palantir's sales.

Contains material from dpa-AFX

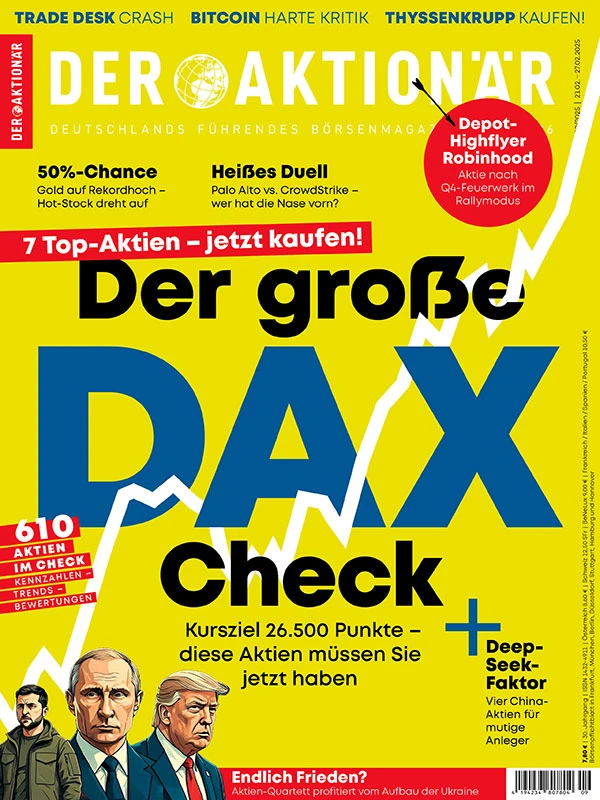

deraktionaer.de