Metalworking: the mother industry that resists the downturn and hopes for mining

Regarding the main metallurgical provinces, it was reported that they maintained positive year-on-year variations, although with less momentum than in previous months. Santa Fe (3.8%) and Córdoba (3.5%) led the ranking thanks to the boost from agricultural machinery activity, a key driver in these production networks. Mendoza (2.1%) and Entre Ríos (0.8%) also registered increases, albeit at a more moderate pace. Meanwhile, companies based in Buenos Aires saw a marginal increase of 0.5%, a clear slowdown compared to April's growth and underperforming the sector as a whole.

Metalworking 1.jpg

On the other hand, companies linked to the automotive industry again posted a decline (-0.9%), despite a slowdown in the decline observed in the first quarter. Meanwhile, suppliers to the oil and gas sector posted a 3.2% drop and remained in negative territory due to continued impacts from reduced orders and a shift in commercial focus at large operators such as YPF and Pan American. Added to this is the lack of finalized contracts in a context of strong influx of imported products.

In Mendoza , a large portion of metalworking companies work with oil, construction, and capital goods. In this context, the industry was affected by YPF's withdrawal from mature wells and the restructuring entailed by the Andes Plan. Although most estimate that this change will have a positive impact on oil production in the medium and long term, activity in Mendoza slowed while the transfer was carried out. Only this year were the companies that won the areas able to actually enter the industry and make the necessary adjustments for each situation.

This had a negative impact not only on the province but also on other oil suppliers in other provinces. "We are seeing slow recoveries since metalworking is important in public works, and furthermore, oil from mature wells has stopped generating activity for the companies affiliated with Asinmet," Solís reflected. He added that some sectors have begun to see improvements, but that this has not yet been significant, as the decline remains below 10 points if we take into account what was lost in 2024.

In this regard, construction has been hit hard nationwide, while in Mendoza the decline had a lesser impact, as some public works projects continued at a slower pace. However, with real estate developments at such a standstill due to sharp cost increases and slow price adjustments, the little that is being done generally takes long and slow turns. "Private construction is unable to sustain idle capacity," Solís emphasized.

Among the products produced by the metalworking industry for construction are metal and aluminum carpentry, press brakes, castings, and other capital goods. It is also increasingly present due to the increasingly widespread manufacture of metal structures using dry construction. This type of small and medium-sized enterprise has had a significant impact. Regarding energy, Asinmet acknowledged that the Andes plan has not yet reactivated the sector and some companies have been severely affected in their service contracting. In the oil sector, the metalworking industry is involved in well maintenance, pump and distillery assistance, construction and assembly, new equipment and expansions, among other areas.

Metalworking 2.jpg

Along the same lines, Tomás Navarro, owner of TYG SA, president of Asinmet Joven, and vice president of UIM Joven , expressed that in Mendoza there was a slight improvement in activity, which is still quite battered. Added to the drag of last year's sharp decline is the uncertainty of an improvement for the remainder of 2025. "The most complicated sectors are Foundry and Capital Goods," Navarro emphasized. Agreeing with Solís, he also mentioned that companies that work for final consumption or for oil and gas are severely slowed, especially since YPF pulled out of several fields in the province.

In Mendoza, Impsa has been and continues to be a leading metalworking company. It was recently recapitalized by private investors and this month celebrated the postponement and restructuring of its US$576 million debt. The change of hands and the commitment the new management has promised in the United States and Yacyretá bring hope to local SMEs that have long supplied this important company. However, the timing of this is still unclear, although industry insiders have celebrated the company's return to the market and the prospect of job creation in the medium term.

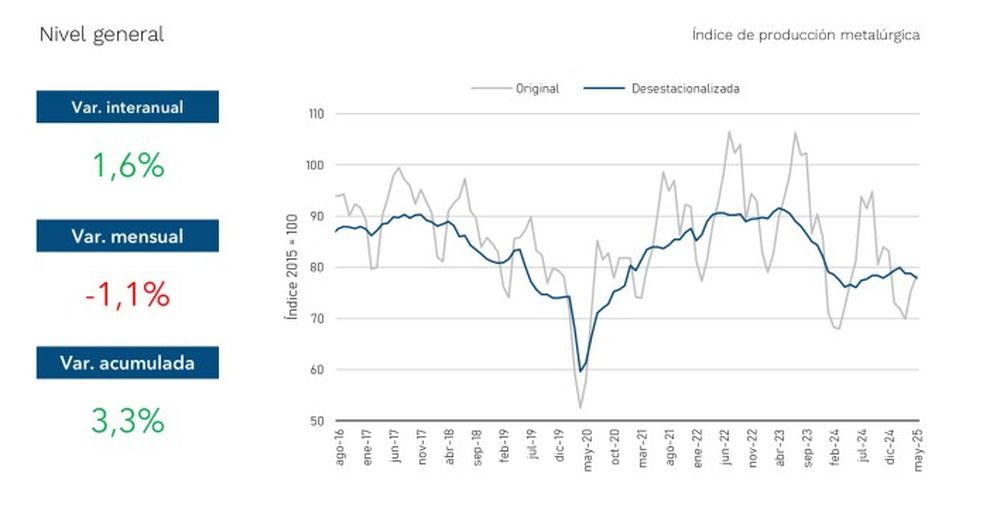

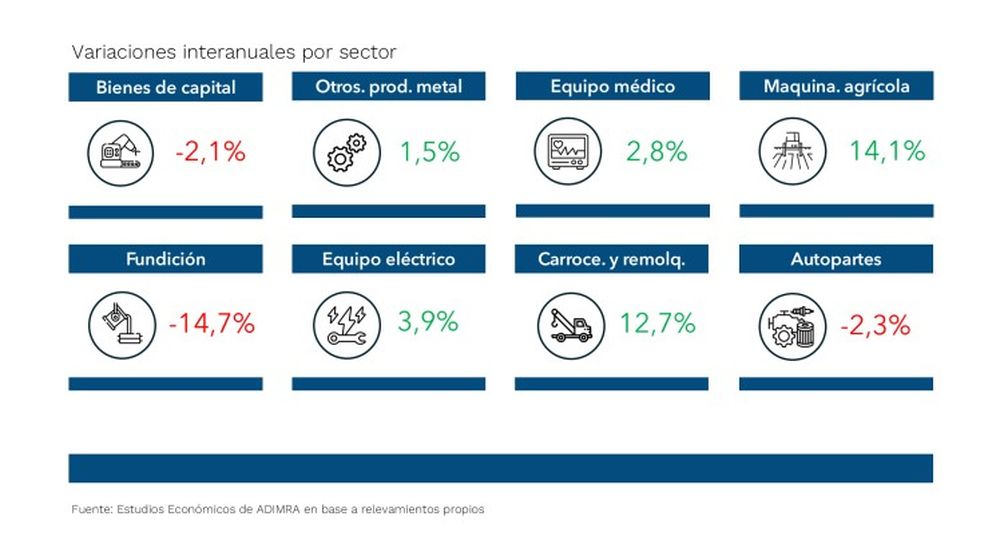

Opening of importsIn May 2025, the Agricultural Machinery (14.1%) and Bodywork and Trailers (12.7%) sectors again stood out as those with the greatest year-on-year growth, according to the Adimra report. These production chains have little impact in Mendoza , as did the auto parts sector, which slightly deepened its decline, with a negative year-on-year variation of 2.3%. Meanwhile, Foundry once again ranked among the most lagging sectors, with a drop of -14.7% after a slight easing in April, so activity remains at minimal levels.

Meanwhile, the Capital Goods sector fell 2.1%, and although it had barely managed to remain in positive territory in April, it again registered a negative variation in May. "The monthly trend suggests a plateau, with no clear signs of recovery," Admira stated. Regarding this last sector, one concern for local industrialists is the opening of imports. According to Franco Totero of the Sur Técnica company and secretary of the Economic Federation of Mendoza (FEM) , the difficulty stems from the fact that tariff reductions are taking place faster than labor and tax costs.

This situation makes local production more expensive than that imported across the country's borders, with China as the main and latent threat. In this regard, Tomás Navarro noted that the opening of imports directly affects the industry. "Competing with products imported from abroad at very low prices, without the same costs we have here, is very difficult," stated the president of Asinmet Joven, adding that this puts local production and jobs at risk. "That's why we have long called for a serious industrial policy that protects those who produce in the country, without closing ourselves off from the rest of the world, but with fair conditions," Navarro stated.

Regarding this, Fabián Solís emphasized that the opening of imports severely affects manufacturers of capital goods, mining machinery, energy, and agribusiness. The leader of the business association added another point about why Argentine products are becoming more expensive beyond the tax and labor costs. "Today, we have expensive credit because the rate is high compared to that of manufacturers in other countries that have real financing," emphasized the leader of Solís SA. He added that there has been no announcement anticipating a tax cut or any type of benefit for compliant companies .

metalworking 3.jpg

The unemployment situation is affecting employment, and while there are no specific figures for Mendoza , the fact is that the layoff has already begun to be felt in the sector. This is despite the efforts made by companies to avoid laying off staff, among other reasons because these are skilled, trained, and specialized workers who are difficult to find in the labor market. The Adimra report highlighted that in May, a year-over-year decline in employment was observed, reaching -1.9%. Compared to the previous month, the number of employees remained stable.

In this regard, Tomás Navarro emphasized that most companies are juggling to stay afloat. In this regard, they are adjusting costs, seeking jobs wherever possible, and making a strong commitment to improving efficiency and productivity internally. "Many companies are trying to maintain employment, even if they are reducing overtime or reorganizing shifts," Navarro explained. He added that they are also trying to take advantage of what little remains of public-private programs, although they are currently quite limited.

Regarding the sectors that performed most positively, the Adimra report highlighted: Electrical Equipment and Appliances (3.9%), Medical Equipment (2.8%), and Other Metal Products (1.5%). "These sectors have maintained a slight but persistent recovery path since the end of 2024, although without a decisive boost," the Adimra report stated. It added that although signs of recovery are consolidating in 2025, the rebound is still uneven.

The potential of miningAmid the concern, a glimmer of hope is emerging with the development of mining not only in Mendoza but also in the rest of the country, with projects that could begin with the support of RIGI. "Mining is a sector that incentivizes the industry, and we celebrate Mendoza's commitment to this," said Fabián Solís. Regarding San Jorge (PSJ), the first project that could begin construction in our province, the president of Asinmet emphasized this, although he clarified that it is a relatively small project for the sector in general.

"We are looking at how we can connect regionally with the provinces of Cuyo, forging strategic alliances, and developing a vision for collaboration between the public and private sectors," Solís emphasized. Along the same lines, Franco Totero, who is also First Vice President of Asinmet, stated that although mining has a long development period, it is an activity that will have a positive impact on the industry. In this regard, he stated that the most important stage is the construction of the mine, and that the PSJ could take two years. The sector is also looking to San Juan, where there are important projects in the pipeline that could begin to materialize in about five years.

Gender and mining Women

"We see it as positive that the government has taken the plunge and embraced the mining sector to begin making mining projects viable," Totero stated. Mendoza has potential here and differentiates itself from other provinces because, thanks to oil, it has a thriving production network. This means that many local companies have been working in metal mining for a long time, but not in other provinces. This means that these companies not only have experience but also various certifications that the mining sector requires to hire services or personnel.

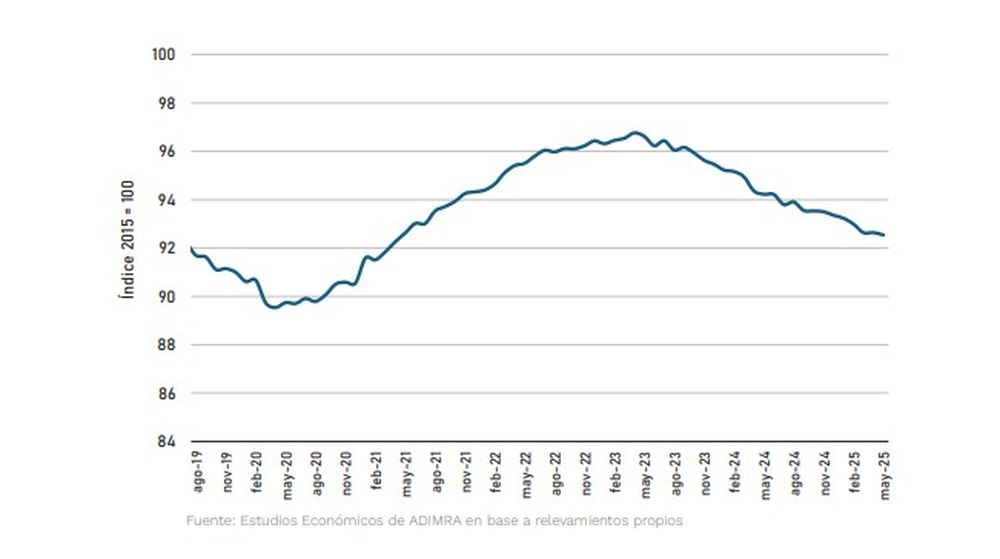

Lean expectationsThe Adimra report highlighted that short-term production expectations in the metalworking industry (the next three months) have shown some slowdown in recent months. It specified that for the rest of this year, 60.5% of companies expect their production to remain unchanged or contract. In this context, more and more companies anticipate a possible drop in their activity levels. Thus, the employment outlook reflects that 16.9% of companies anticipate possible reductions in their workforce, while 69.2% expect no significant changes.

For Fabián Solís, continuing work on projects that generate consensus will be important for the remainder of the year. Likewise, working toward increased business productivity is key, since—in line with the Adimra report—no major changes are foreseen in the macroeconomic context. Similarly, for Navarro, most companies are cautious. That is, they don't expect a major rebound, but rather a maintenance of current conditions or, in some cases, even greater declines than those experienced. "What we're asking for is stability, access to credit, clear rules, and predictability to plan," Navarro noted, adding that without these basic parameters, it will be very difficult for anyone to be encouraged to invest or grow.

In general, the Argentine metalworking industry supplies components to the domestic market, with a smaller export sector. Regarding exports, the Adimra report highlighted that the latest available data is from April. Within this framework, metallurgical product exports totaled $476 million, representing a year-over-year increase of 7.4%.

On the other hand, imports of metallurgical goods increased by 29.4% compared to the same month last year. Significant increases were observed in imports of capital goods, reaching record levels. On a monthly basis, imports of metallurgical products continue to grow at an average monthly rate of 4.9%, based on June of the previous year, which was the lowest point in the decline in foreign purchases.

losandes