More extreme student debt, sometimes more than 100,000 euros

The figures are based on data from Statistics Netherlands ( CBS ). According to the agency, fewer students have applied for loans since the reintroduction of the basic grant for higher education (higher professional education and university) in 2023.

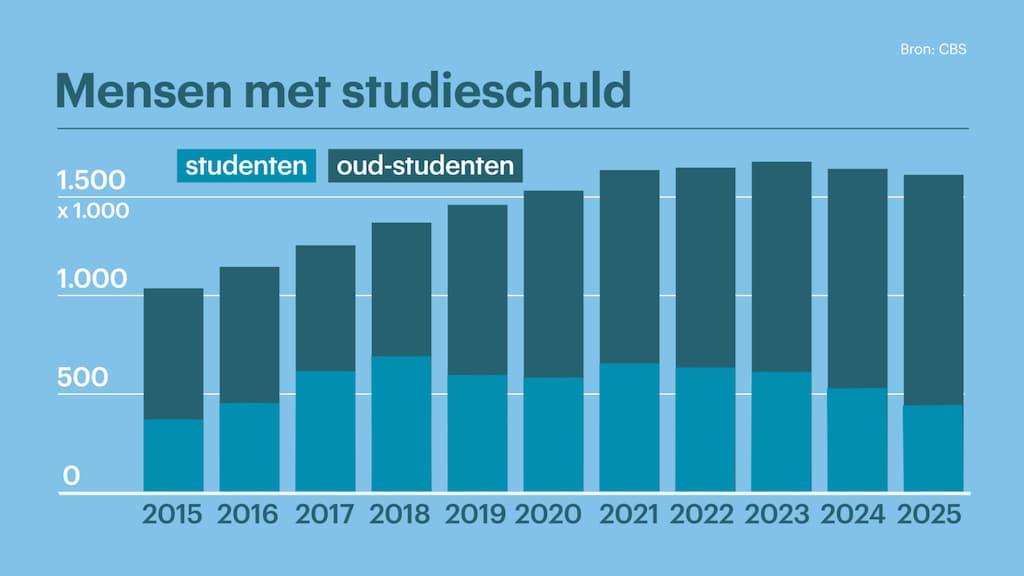

At the beginning of this year, over 1.1 million former students had student loan debt, a number that has "continued to grow steadily" in recent years. The number of students still dealing with such debt is actually decreasing: 460,000 by the beginning of 2025. That's 150,000 fewer than in 2023, according to Statistics Netherlands (CBS).

Currently, 146,000 people have student debt of at least €50,000, almost 10,000 more than in 2024. For more than 3,000 people, this debt has even reached €100,000 or more, according to Statistics Netherlands (CBS). Nearly half have debts of less than €10,000.

The average student debt is growing, the statistics agency notes: "Since the loan system was introduced in 2015, the average student debt has increased by 5,800 euros to 18,200 euros in 2025."

The reintroduction of the basic student grant ended the student loan system, which had been fiercely criticized by student organizations for years. The amount of the grant depends on your living situation and is around €125 per month for those living at home and around €315 for those living away from home.

For students who graduate within ten years, the student grant will be converted into a gift.

Student Jochem van der Heijden (23) now has a debt of more than 50,000 euros, he says in an interview with RTL Z. He started studying in Leiden in 2019, first International Business, later Psychology. Corona intervened, he says.

"That's why it took me longer, also to decide what I actually wanted," said the student. He didn't receive a basic grant. He said he belonged to the " unlucky group " who just missed out on the allowance and therefore had to borrow money.

To compressVan der Heijden is currently studying in The Hague and hopes to graduate soon. The high debt isn't a major problem yet: "I'm putting it off because I'm still studying, but when I start living with someone, working, or want a mortgage, that will change." He does call the debt a nuisance, especially since there's also interest on top of that.

Among former students, this debt is on average higher than among current students, according to Statistics Netherlands (CBS). Among the latter group, the average debt is also decreasing.

Since the reintroduction of the basic grant, the number of students receiving such a grant has increased. The number of students receiving a supplementary grant is also growing, as more people are eligible. This results in a total increase in student grants: €2.7 billion in 2024.

Better walletEarlier this year, ABN AMRO also calculated that students have borrowed less money and started working more hours since the return of the basic grant, which some students may also feel in their wallets.

Before 2015, students were also entitled to a monthly basic grant, but this was abolished, making students financially dependent on loans, part-time wages, or parental contributions.

Ultimately, partly after protests, the basic grant was reintroduced in 2023.

Want to get rid of that student loan? With a bit of luck, you can do it faster through your employer, as you can see in this video:

RTL Nieuws