Banks push for Yuan trade in GIFT City as India-China ties warm up

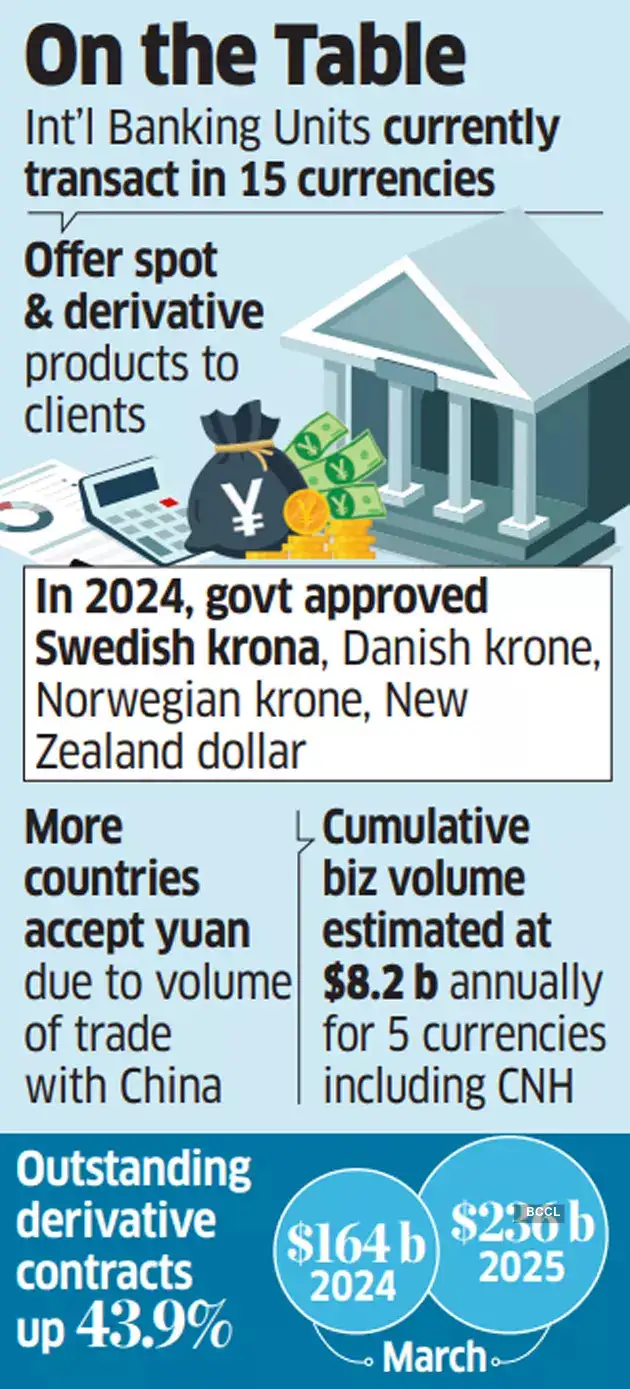

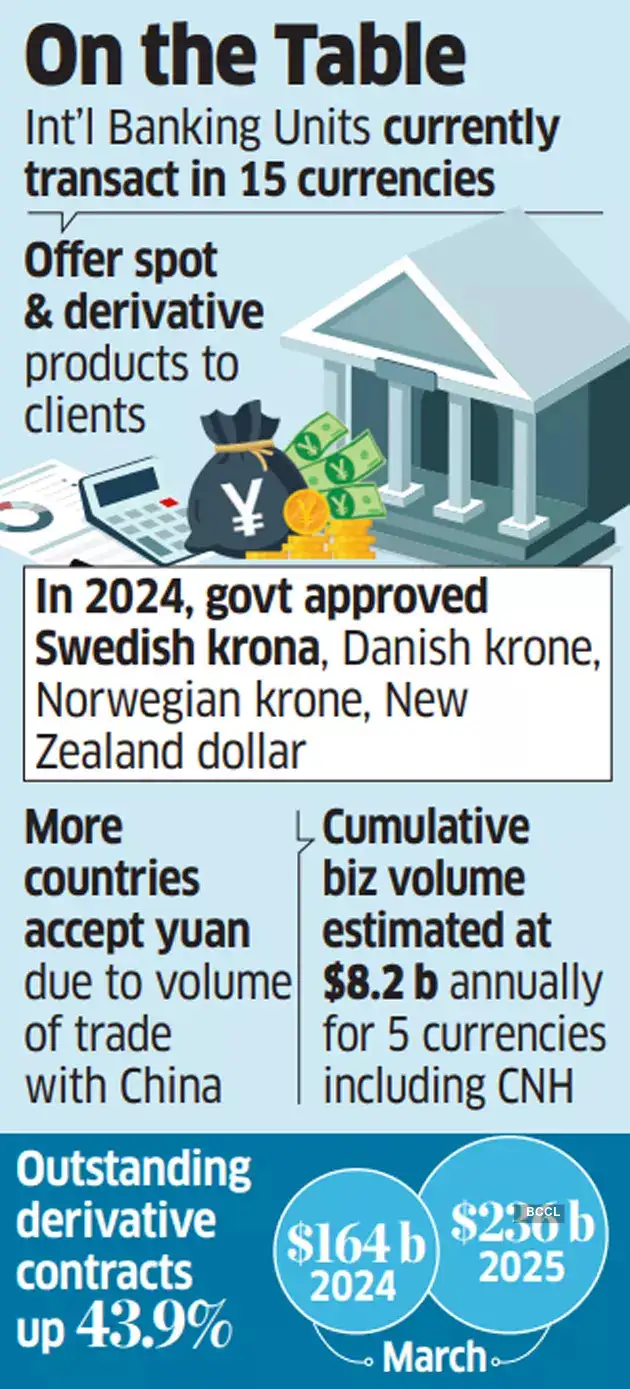

With ties between India and China easing up, the Centre and the International Financial Services Centre Authority (IFSCA) are considering a suggestion by banks to allow International Banking Units (IBUs) in the Gujarat International Finance Tec City or GIFT City to transact in offshore renminbi (CNH).GIFT City is an International Financial Services Centre, functioning as a global centre for financial and professional services. The recommendation was made to the government and the IFSCA in October, said people familiar with the development.“This was proposed to the government and the IFSCA after an internal meeting in which some banks made a strong case for transactions in offshore renminbi (CNH) as it is a widely accepted currency,” said a senior bank executive. Enjoying Free FloatThe bank executive added that this would allow banks to offer a wider range of products and services to clients. CNY or Chinese yuan is the symbol for onshore renminbi and CNH for the offshore market. This will be a significant opportunity for Indian banks as more countries are accepting transactions in yuan on account of the volume of trade with China. IBUs are permitted to transact in 15 currencies and offer spot and derivative products to clients.In 2024, IBUs pegged the cumulative business volume estimate for five currencies, including CNH, at $8.2 billion per year. The IFSCA had then recommended that since all these five currencies enjoy free float and rank in the top 20 in terms of usage in international payments by value, they should be allowed.“The government, however, after due consideration, decided to allow four currencies except offshore renminbi (CNH), but now with the thaw in the relations between the two countries, the proposal is again being reviewed,” said an official. “The decision will be taken at the highest level.” The IFSCA didn’t respond to queries.The four currencies approved in 2024 were the Swedish krona (SEK), Danish krone (DKK), Norwegian krone (NOK) and New Zealand dollar (NZD). According to experts, allowing renminbi-rupee transactions will benefit both countries and deepen liquidity for both currencies in the offshore markets at a time when the dollar still rules despite attempts to dethrone it.“To survive and thrive in a multipolar world, it is important to keep relationships with every group, and currency recognition for the purpose of trade is the best form of initiating a relationship,” said Vivek Iyer, partner and leader of financial services risk advisory, Grant Thornton Bharat.

Enjoying Free FloatThe bank executive added that this would allow banks to offer a wider range of products and services to clients. CNY or Chinese yuan is the symbol for onshore renminbi and CNH for the offshore market. This will be a significant opportunity for Indian banks as more countries are accepting transactions in yuan on account of the volume of trade with China. IBUs are permitted to transact in 15 currencies and offer spot and derivative products to clients.In 2024, IBUs pegged the cumulative business volume estimate for five currencies, including CNH, at $8.2 billion per year. The IFSCA had then recommended that since all these five currencies enjoy free float and rank in the top 20 in terms of usage in international payments by value, they should be allowed.“The government, however, after due consideration, decided to allow four currencies except offshore renminbi (CNH), but now with the thaw in the relations between the two countries, the proposal is again being reviewed,” said an official. “The decision will be taken at the highest level.” The IFSCA didn’t respond to queries.The four currencies approved in 2024 were the Swedish krona (SEK), Danish krone (DKK), Norwegian krone (NOK) and New Zealand dollar (NZD). According to experts, allowing renminbi-rupee transactions will benefit both countries and deepen liquidity for both currencies in the offshore markets at a time when the dollar still rules despite attempts to dethrone it.“To survive and thrive in a multipolar world, it is important to keep relationships with every group, and currency recognition for the purpose of trade is the best form of initiating a relationship,” said Vivek Iyer, partner and leader of financial services risk advisory, Grant Thornton Bharat.

Enjoying Free FloatThe bank executive added that this would allow banks to offer a wider range of products and services to clients. CNY or Chinese yuan is the symbol for onshore renminbi and CNH for the offshore market. This will be a significant opportunity for Indian banks as more countries are accepting transactions in yuan on account of the volume of trade with China. IBUs are permitted to transact in 15 currencies and offer spot and derivative products to clients.In 2024, IBUs pegged the cumulative business volume estimate for five currencies, including CNH, at $8.2 billion per year. The IFSCA had then recommended that since all these five currencies enjoy free float and rank in the top 20 in terms of usage in international payments by value, they should be allowed.“The government, however, after due consideration, decided to allow four currencies except offshore renminbi (CNH), but now with the thaw in the relations between the two countries, the proposal is again being reviewed,” said an official. “The decision will be taken at the highest level.” The IFSCA didn’t respond to queries.The four currencies approved in 2024 were the Swedish krona (SEK), Danish krone (DKK), Norwegian krone (NOK) and New Zealand dollar (NZD). According to experts, allowing renminbi-rupee transactions will benefit both countries and deepen liquidity for both currencies in the offshore markets at a time when the dollar still rules despite attempts to dethrone it.“To survive and thrive in a multipolar world, it is important to keep relationships with every group, and currency recognition for the purpose of trade is the best form of initiating a relationship,” said Vivek Iyer, partner and leader of financial services risk advisory, Grant Thornton Bharat.

Enjoying Free FloatThe bank executive added that this would allow banks to offer a wider range of products and services to clients. CNY or Chinese yuan is the symbol for onshore renminbi and CNH for the offshore market. This will be a significant opportunity for Indian banks as more countries are accepting transactions in yuan on account of the volume of trade with China. IBUs are permitted to transact in 15 currencies and offer spot and derivative products to clients.In 2024, IBUs pegged the cumulative business volume estimate for five currencies, including CNH, at $8.2 billion per year. The IFSCA had then recommended that since all these five currencies enjoy free float and rank in the top 20 in terms of usage in international payments by value, they should be allowed.“The government, however, after due consideration, decided to allow four currencies except offshore renminbi (CNH), but now with the thaw in the relations between the two countries, the proposal is again being reviewed,” said an official. “The decision will be taken at the highest level.” The IFSCA didn’t respond to queries.The four currencies approved in 2024 were the Swedish krona (SEK), Danish krone (DKK), Norwegian krone (NOK) and New Zealand dollar (NZD). According to experts, allowing renminbi-rupee transactions will benefit both countries and deepen liquidity for both currencies in the offshore markets at a time when the dollar still rules despite attempts to dethrone it.“To survive and thrive in a multipolar world, it is important to keep relationships with every group, and currency recognition for the purpose of trade is the best form of initiating a relationship,” said Vivek Iyer, partner and leader of financial services risk advisory, Grant Thornton Bharat.economictimes