How did the markets react to the Central Bank's interest rate cut? What is the trend in gold and foreign exchange? An expert commented in A Haber.

The Monetary Policy Committee (MPC) of the Central Bank of the Republic of Türkiye (CBRT) convened today under the chairmanship of Central Bank Governor Fatih Karahan.

The Monetary Policy Committee announced its fifth interest rate decision for 2025. The Committee lowered the policy rate by 300 basis points to 43%.

The Board also reduced the overnight lending rate from 49 percent to 46 percent and the overnight borrowing rate from 44.5 percent to 41.5 percent.

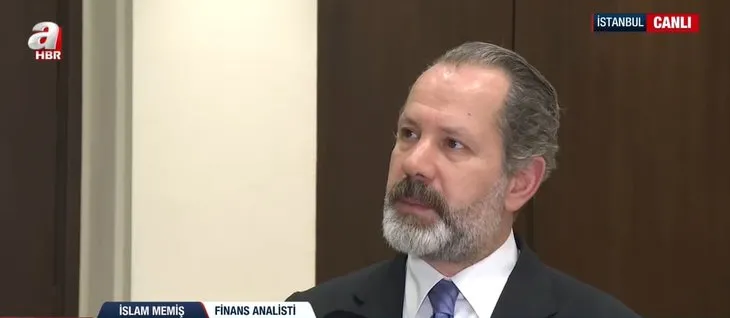

How did the markets react to the interest rate decision? What is the trend in gold and foreign exchange? Financial Analyst İslam Memiş, guest of A Haber reporter Merve İzci Özmen, assessed the market.

"WE EXPECT INTEREST RATE REDUCES TO CONTINUE"

Financial Analyst İslam Memiş's comments are as follows: The Central Bank of the Republic of Turkey (CBRT) cut interest rates in line with market expectations. We're talking about a 300 basis point rate cut. 250 basis points was the expected minimum interest rate, and 400 basis points the maximum. However, the Central Bank, speaking the same language and sharing the same sentiment as the market, technically made an interest rate cut. We expect the CBRT to continue reducing interest rates in the future. This is also the general market expectation. We expect the rate cuts to continue, commensurate with inflation. This move by the CBRT has likely strengthened the likelihood of a continued decline in inflation. And we are currently observing a positive interaction with the markets.

On the Borsa Istanbul, it continues its upward trend, rising by up to 1 percent above the 10,600-point level. We observe no negative interaction here, but rather a slightly more positive one. Exchange rates are stable, and we will continue to closely monitor the impact of banks' interest rate cuts going forward. So, it's now the banks' turn. We expect banks to support citizens with their loans and, from now on, to pass these interest rate cuts on to citizens and the business sector.

ahaber